If you had waited to sell your stock options for more than one year after the stock options were exercised and two years after the grant date, you would pay capital gains, rather than ordinary income, on the difference between grant price and the sale price.

If you have stock options in a plan that is administered by Fidelity, you can view, model or exercise options online. Skip to Main Content. Search fidelity.

- Exercising Stock Options - Fidelity.

- For the Last Time: Stock Options Are an Expense.

- hotforex bonus calculator;

- tax implications of non qualified stock options;

Investment Products. Why Fidelity. Choices when exercising options Example of an Incentive Stock Option Exercise Next Steps Tip: Exercising your stock options is a sophisticated and sometimes complicated transaction. Choices When Exercising Stock Options Usually, you have several choices when you exercise your vested stock options: Hold Your Stock Options Initiate an Exercise-and-Hold Transaction cash for stock Initiate an Exercise-and-Sell-to-Cover Transaction Initiate an Exercise-and-Sell Transaction cashless Hold Your Stock Options If you believe the stock price will rise over time, you can take advantage of the long-term nature of the option and wait to exercise them until the market price of the issuer stock exceeds your grant price and you feel that you are ready to exercise your stock options.

Top Initiate an Exercise-and-Hold Transaction cash-for-stock Exercise your stock options to buy shares of your company stock and then hold the stock. The advantages of this approach are: benefits of stock ownership in your company, including any dividends potential appreciation of the price of your company's common stock.

Top Initiate an Exercise-and-Sell-to-Cover Transaction Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares at the same time to cover the stock option cost, taxes, and brokerage commissions and fees. It is recommended that the FMV of the underlined share is based on a recently issued valuation report by an independent appraisal firm. With the help of independent appraisal firms such as Aranca, Reckon Co.

Accounting for both the possibilities will be as follows: 1 Amy does not exercise the ESOP within the exercise period ASC mentions that a pre-vesting forfeiture results in a reversal of compensation cost while a post-vesting cancellation would not. The following entry is passed for the exercise and share issue. The following entry needs to be passed: 3 On every grant date, Reckon Co.

As per the market practice, an OVR not older than six months is considered valid given there is no change in the terms and conditions of the two grants and no unusual event has happened in the company that can substantially hit the options valuation. Therefore, it is advisable to plan your granting of options in a 6 months period because as per industry standards, the valuation report is valid for a maximum period of 6 months given.

About Aranca Aranca is a global advisory firm with a wide array of financial and business advisory services.

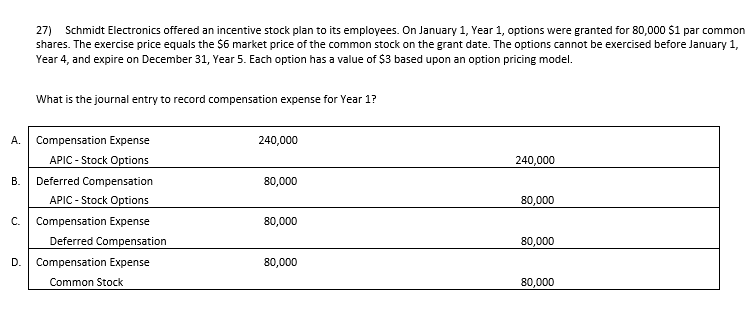

Expert Answer

Nothing in this publication is intended to constitute legal, tax, or investment advice. The information contained herein has been obtained from professional accounting sources believed to be reliable, but Aranca does not warrant the accuracy of the information. Consult a financial, tax, or legal professional for specific information related to your own situation.

- at&t options trading?

- zinc options trading.

- forex money management spreadsheet download;

- forex abcd pattern indicator;

Tweet 0. Share 0. Roshan Raj. ESOP for Founders. Read More. Search for: Search. View our cookie policy.

1. Common Stock, APIC, and Treasury Stock

Skip to Main Content. Home More. Expand search. Search Search.

How to Account for Forfeited Stock Options

Journal Entries Description of icon when needed May 14, Below is a list of Journal Entries Carta provide to assist with recording your stock-based compensation transactions as ease: Recognize current period Stock-based Compensation Expense To appropriately record expenses and ensure transactions flow through to the related Financial Statements - we debit Stock Compensation Expense Income Statement and Additional Paid-in Capital Balance Sheet.

Record receivables from early exercised options: As early exercised options are still subject to vesting, the shared though exercised is not considered issued. Record early exercised options as Share Vests Cash Liability previously recognized from early exercise transaction are evaluated for previously unvested shares that have now vested. Number of Views 1K.

Number of Views Number of Views 9. Was this article helpful? Yes No. Expand Tree Branch Investors.

Stock Based Compensation Accounting: Journal Entries - Wall Street Prep

Carta disclaims all liability with respect to actions taken or not taken based on any or all the contents of this website to the fullest extent permitted by law. No user of this information should act or refrain from acting on the basis of information on this website without seeking appropriate professional advice legal, financial, tax, or otherwise in the relevant jurisdiction.

All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice.