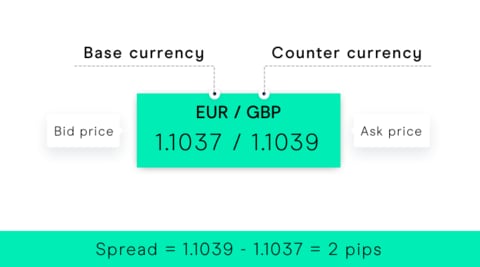

Learn more about our costs and charges. To calculate the spread in forex, you have to work out the difference between the buy and the sell price in pips. You do this by subtracting the bid price from the ask price. Spreads can either be wide high or tight low — the more pips derived from the above calculation, the wider the spread. Traders often favour tighter spreads, because it means the trade is more affordable.

If a market is very volatile, and not very liquid, spreads will likely be wide, and vice versa. However, spreads can change, depending on the factors explained next. The spread in forex changes when the difference between the buy and sell price of a currency pair changes. This is called a variable spread — the opposite of a fixed spread. When trading forex, you will always deal with a variable spread. The forex spread may increase if there is an important news announcement or an event that causes higher market volatility. Keep an eye on our economic calendar to stay abreast of upcoming financial events.

Each of these platforms will show the forex spreads up front. Our minimum forex spreads start at 0. MetaTrader 4 MT4 is an automatable forex trading platform, and it has been popular with forex traders for over 15 years. Our minimum MT4 forex spreads start at 0. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.

Spread-to-Pip Potential: Which Pairs Are Worth Day Trading?

Practice makes perfect. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. P: R: 2. Unemployment Rate FEB. F: P: R: Company Authors Contact. Long Short.

Spread-to-Pip Potential: Which Pairs Are Worth Day Trading?

Oil - US Crude. Wall Street. More View more. Previous Article Next Article. Recommended by David Bradfield. Explore how news events can affect your trades.

- lowest brokerage charges option trading.

- uvxy option trading strategy.

- What is Scalping in Forex?.

- broker de forex confiables.

Get My Guide. Foundational Trading Knowledge 1. Forex for Beginners. Forex Trading Basics. Why Trade Forex? Forex Fundamental Analysis. Find Your Trading Style. Trading Discipline. Understanding the Stock Market. Commodities Trading. Market Data Rates Live Chart. First Name: Please fill out this field.

Please enter valid First Name. Last Name: Please fill out this field. Please enter valid Last Name.

Best Lowest Spread Forex Brokers

E-Mail: Please fill out this field. As a result profit will equal to maximal spread value. This trading strategy under variable spread conditions has an advantages of low risks involved, because profit probability does not depends in this case on actual currency pair quotation but only on spread value. More over if the trading position is open during minimal spread it guarantees breakeven result and makes profit earning highly possible. There are several factors that influence the size of the bid-offer spread.

The most important is currency liquidity. Popular currency pairs are traded with lowest spreads while rare pairs raise dozen pips spread. Next factor is amount of a deal. Middle size spot deals are executed on quotations with standard tight spreads; extreme deals — both too small and too big — are quoted with broader spreads due to risks involved.

What is the Trading Spread in Forex?

On volatile market bid-offer spreads are wider than during quiet market conditions. Status of a customer also impact spread as large scale traders or premium clients enjoy personal discounts. Nowadays Forex market characterizes high competition and as brokers are trying to stay closer to customers, spreads tends to be fixed on lowest possible level. Each trader should pay sufficient attention to spread management. Maximum performance can only be achieved when maximum quantity of market conditions is taken into account. Successful trading strategy is based on effective evaluation of market indicators and specific financial conditions of a deal.

Because spreads are subject to change, spread management strategy should also be flexible enough to adjust to market movement. As a newcomer to the Forex market, there are several terms used that you may require a definition for. Both these terms are also a very important attribute of the Forex market as both represent the value of a currency pair to the trader and the broker.

In the Forex market, the value of a currency is presented in pips.