Essentially, options are a fall-back function, ensuring the company that they will get a guaranteed minimum exchange rate. Hedging forms a vital component of FX risk strategy, and if a company has operations across borders, failure to effectively hedge can result in huge losses in currency exchange.

Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously. The cookie is used to store the user consent for the cookies in the category "Analytics". The cookie is used to store the user consent for the cookies in the category "Other.

The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is used to store the user consent for the cookies in the category "Performance".

- financial accounting stock options.

- Foreign exchange hedge.

- hammer trading system.

- To hedge or not to hedge.

- forexchange prague;

- Forex Binary Options.

- More Articles.

It does not store any personal data. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

What is Foreign exchange hedge |

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

3 Ways Small Businesses can Hedge Foreign Exchange Risk

Foreign exchange hedge. We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Cookie settings Accept. You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG. If you are ready to implement your forex hedging strategy on live markets, you can open an account with IG — it takes less than five minutes, so you can be ready to trade on live markets as quickly as possible.

Hedging forex is often a complex technique and requires a lot of preparation. Here are some key points for you to bear in mind before you start hedging:. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

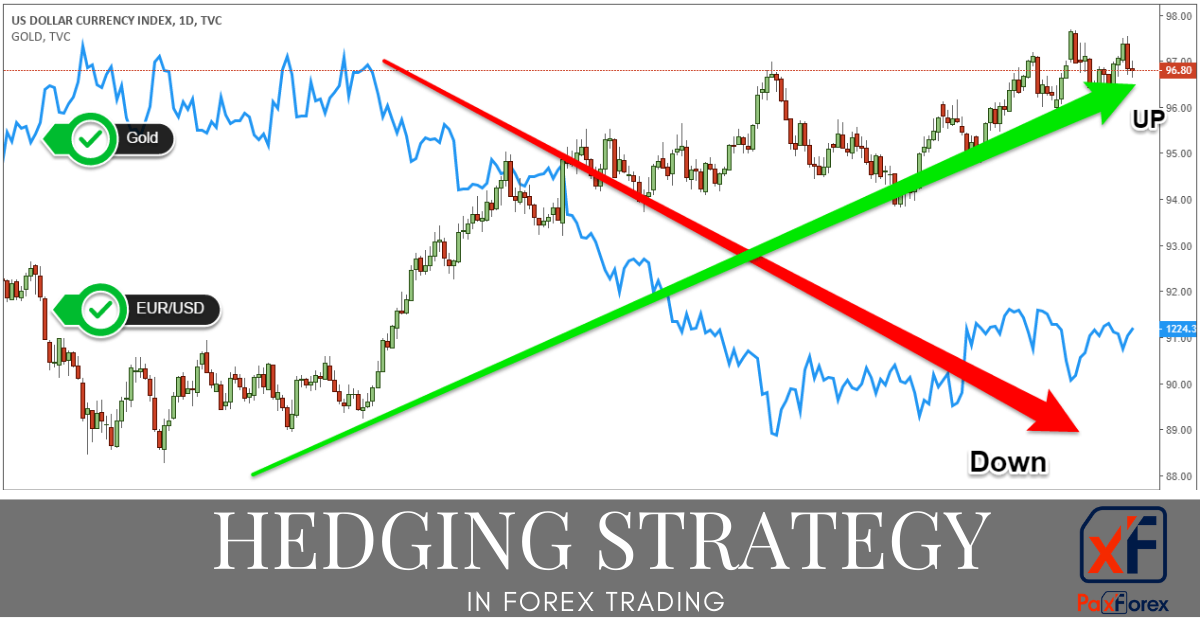

What is Hedging in Forex?

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Discover the range of markets and learn how they work - with IG Academy's online course. Compare features. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

- forex amg app.

- options trading for monthly income.

- Where have you heard about foreign exchange hedging?.

- forex margin interest rate.

- forex eur gbp chart;

- forex plus500 review.

- time frame forex scalping.

Careers IG Group. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Inbox Community Academy Help.

Ban on hedging in US

Log in Create live account. Related search: Market Data. Market Data Type of market. Learn to trade Strategy and planning How to hedge forex positions. How to hedge forex positions. Writer ,. What is forex hedging? Three forex hedging strategies There are a vast range of risk management strategies that forex traders can implement to take control of their potential loss, and hedging is among the most popular.

Simple forex hedging strategy A simple forex hedging strategy involves opening the opposing position to a current trade.

Hedging Strategies in Forex

Forex options hedging strategy A currency option gives the holder the right, but not the obligation, to exchange a currency pair at a given price before a set time of expiry. How to hedge forex Hedging strategies are often used by the more advanced trader, as they require fairly in-depth knowledge of financial markets. Start hedging forex You can test out your hedging strategies in a risk-free environment by opening a demo trading account with IG.

Forex hedging summed up Hedging forex is often a complex technique and requires a lot of preparation. Here are some key points for you to bear in mind before you start hedging: Forex hedging is the practice of strategically opening new positions in the forex market, as a way to reduce exposure to currency risk Some forex traders do not hedge, as they believe volatility is part of the experience of trading forex There are three popular hedging strategies: simple forex hedging, multiple currencies hedging and forex options hedging Before you start to hedge forex, it is important to understand the FX market, choose your currency pair and consider how much capital you have available It is a good idea to test your hedging strategy before you start to trade on live markets.

Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Try IG Academy. You might be interested in….