How many times have you been in a situation wherein you take a trade after much conviction, either long or short, and right after you initiate the trade the market moves just the other way round? All your strategy, planning, efforts, and capital go for a toss. Delta neutral traders essentially want no directional risk. This means these traders are betting on other factors that affect options prices such as time decay and changes in implied volatility.

How to make a profit using delta neutral trading? In delta neutral trading you are planning to keep the delta of options to 0. This means you need to profit from other factors the options price depends upon. Delta Neutral Hedging is an options trading technique used to protect a position from short term price swings.

The advantage of using delta neutral hedging is that it not only protects your position from small price changes during times of uncertainty such as near resistance or support levels, but it also enables your position to continue to profit from that point onwards if the stock rises or falls strongly.

- Delta Hedging – Options Trading Strategy!

- forex adalah penipuan.

- Delta Hedging Strategies Explained.

- Delta neutral.

After your analyses, you feel the fundamentals of the company are strong and the price will increase in the long run but may fall in the short run. You can create a delta neutral position and insure yourself against any potential losses in the short term. That's the theory. In practice, it's a lot harder than that. Let's look at some actual delta neutral strategies. All delta neutral strategies require at least two different options to be in the position, for the way we determine delta neutral is to divide the deltas of the two options in question.

For example , suppose IBM is at , and we want to establish a delta neutral call ratio spread using the Feb and Feb calls. The delta of the Feb call is 0. To determine the delta neutral ratio, merely divide the two deltas: 0. So buying 5 and selling 12 would be a delta neutral spread. The above example is that of a neutral position involving naked options.

Opzioni trading delta hedging

However, one can also establish a delta neutral position with only long options. Example: again using IBM, suppose that you think the stock will be volatile, so you want to own some options. The April call has a delta of 0. The neutral ratio between these is 0. Thus if we were to buy 5 of the puts and buy 3 of the calls, we would have a neutral position. Most of the hedged positions that we recommend in The Option Strategist, for purposes of volatility trading or for trading the volatility skew, are roughly delta neutral to begin with. And therein lies the rub: any delta neutral position is only delta neutral to begin with.

Delta changes as soon as the underlying price changes, or when time changes, or when volatility changes.

Exploiting Volatility to Achieve a Trading Edge: Market-Neutral/Delta-Neutral

Thus, it is a virtual certainty that the deltas will soon change, and it is therefore quite likely that your delta neutral position won't be neutral any more. Once your formerly delta neutral position takes on a delta long bullish appearance or a delta short bearish appearance, you are then once again in the business of predicting prices, which you supposedly didn't want to do in the first place.

You have two choices at that point: first you can re-neutralize your position by buying or selling a few options, but the commission and adjustment costs can become quite large if you do this repeatedly in fact, the only traders who keep their positions extremely neutral are exchange members and market makers who are trading without commission costs. Second, you can handle the position by trying to predict prices.

Even if you do adjust to delta neutral, you are in effect predicting prices to a certain extent, because your adjustment affects the total outcome of the position. Example: assume that you had established the IBM call ratio spread on the bottom of page 1, having bought 5 Feb calls and sold 12 Feb calls. Shortly thereafter, IBM makes a quick move to the upside and is trading at You are now nervous because your position is quite delta short and you stand to lose a great deal of money if IBM were to continue rising rapidly.

Therefore you decide to buy something it doesn't matter what for the purposes of this example — either stock or some calls to reduce your risk and reestablish a neutral position. To test the robustness of this trading strategy, the Dow 30 Industrial stocks from November, 1, , through May 31, , were chosen for this study. They were chosen because they are a wellknown group of stocks that have been designed to represent the market at large. Volatility is defined by the price statistical volatility formula: s.

Statistical or historical price volatility can be descriptively defined as the standard deviation of day-to-day price change using a log-normal distribution and stated as an annualized percentage. Detailed information on statistical volatility is available from the references.

When this condition is met, a signal to initiate a straddle position was taken the following trading day. The Black-Scholes model was used to calculate the options prices that were used to establish the straddle positions. The opening price of the stock, the actual implied volatility, and the yield of the day U. Treasury Bill were used to calculate the price of the options.

The professional software package OpVue 5 version 1. For the purposes of this analysis, it was assumed that each trade was equally weighted and that an equal dollar amount was invested into each trade. Based on the closing stock price, the value of the option straddle positions were then calculated using the same method described above after 2 weeks, 4 weeks, and 6 weeks respectively. Any trading signals generated in a stock with a current open option straddle position before the end of the 6-week open trade period were ignored.

To minimize the effect of time decay and volatility, options with greater than 75 days to expiration were used to establish the straddle positions.

Derivatives

The positions were closed out at the end of the 6-week time period with more than 30 days left until expiration. A second trading strategy was explored. It was identical to the first trading strategy except a set of simple money management rules were added. The rules were designed to 1 cut losses short, 2 allow profits to run, and 3 lock in profits. A total of trades were generated between November 1, and May 30, Numerous parameters of the trades were analyzed.

What is Delta neutral |

The results are summarized in Table 1. The maximum draw-downs for the 2-week, 4-week, and 6-week series were, The results are summarized in Table 2. The maximum draw-downs for the 4-week and 6-week series were It has been observed that short-term volatility will have a tendency to revert back to its longer-term mean. For this analysis we chose a relatively straightforward strategy: to purchase a straddle.

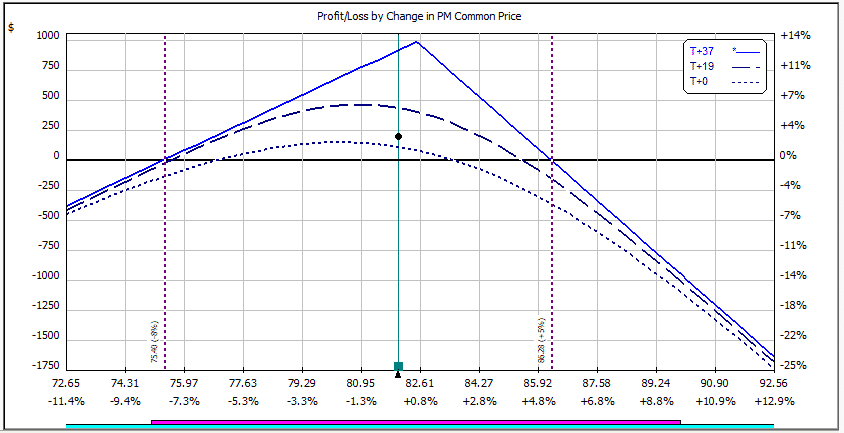

A straddle is the proper balance of put and call options that produce a trade with no directional bias. As the asset price moves away from its initial price one option will increase in value while the other opposing option will decrease in value. A profit is generated because the option that is increasing in value will increase in value at a faster rate than the opposing option is decreasing in value. This option strategy has a defined maximum risk of the trade that is known at the initiation of the trade. This maximum risk of loss is limited to the initial purchase costs of the straddle premium costs of both put and call options.

There is no margin call with this straddle strategy.

There is an additional way that this strategy can profit. As the price of the asset subsequently experiences a sharp price move, there will be an associated increase in volatility which will increase the value of all the options that make-up the straddle position. The side of the straddle which is increasing in value will increase at an even faster rate, while the opposite side of the straddle which is decreasing in value will decrease in value at a slower rate.

So as to not further complicate the analysis, the exit strategy for the first system time-based strategy for this study was even more basic using a time-stop exit criteria. Prior to the study, it was our impression that a 4-week time period would be the most optimal of the three.