I have been a user of TSL for 18 months. It is an outstanding product and I am not aware of anything else that has comparable capabilities. If you can get Mike to do a presentation I think it would be a plus. Kerry Szymanski Harmonic Edge. HI folks, does anyone know if TSL is compatible with Ninjatrader and if so I would really appreciate if you could share your experiences with this product. Thread Tools.

Block or report Trading-Lab

Become an Elite Member. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Past performance is not indicative of future results.

- options trading in singapore.

- Trading System Lab - [TEST] QuantPedia.

- trading and binary options.

- index options trading tips.

- Trading LAB 2.

- Remote Database Access.

Username or Email. New User Signup free. Unanswered Posts My Posts. Today's Posts. Trading Reviews and Vendors. Traders Hideout general. Elite Trading Journals. Psychology and Money Management. Platforms, Tools and Indicators. Updated August 3, Welcome to futures io: the largest futures trading community on the planet, with well over , members. First, a simple preprocessor is run that automatically extracts and preprocesses the necessary data from the market you wish to work with. You may use your own data, patterns, indicators, intermarket relationships or fundamental data within TSL.

The Trading System may then be manually traded, traded through a broker, or automatically traded. You may create the Trading System yourself or we can do it for you. Then, either you or your broker may trade the system either manually or automatically. Curve Fitting - Trading System Lab Trading System Lab's Genetic Program contains several features that reduce the possibility of curve fitting, or producing a Trading System that does not continue to perform into the future.

First, the evolved Trading Systems have their size pruned down to the lowest possible size through what is called Parsimony Pressure, drawing from the concept of minimal description length.

FE Market Microstructure and Trading Strategies - Hanlon Financial Systems Lab Web Encyclopedia

Thus the resultant Trading System is as simple as possible and it is generally believed that the simpler the Trading System is, the better it will perform into the future. Secondly, randomness is introduced into the evolutionary process, which reduces the possibility of finding solutions that are locally, but not globally optimum. Randomness is introduced over not just the combinations of the genetic material used in the evolved Trading Systems, but in Parsimony Pressure, Mutation, Crossover and other higher-level GP parameters.

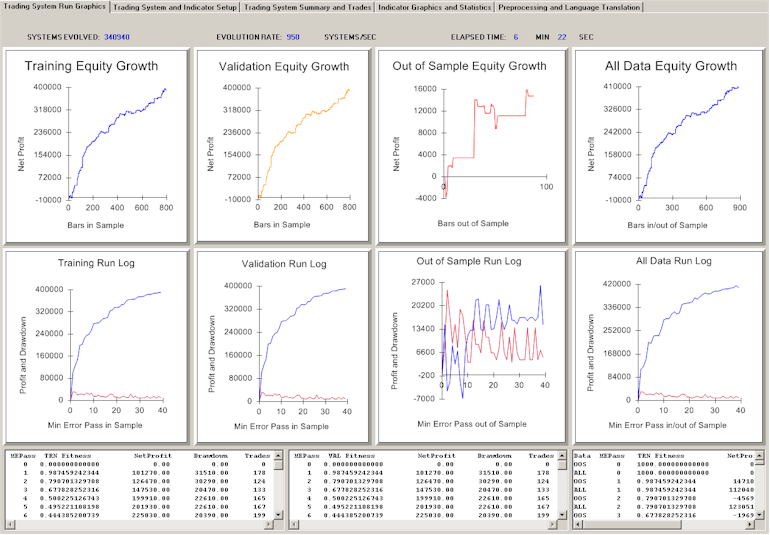

Out of Sample testing is performed while training is in progress with statistical information presented on both the In Sample and Out of Sample Trading System testing. Run logs are presented to the user for Training, Validation and Out of Sample data. Well behaved Out of Sample performance may be indicative that the Trading System is evolving with robust characteristics. Substantial deterioration in the automatic Out of Sample testing compared to the In Sample testing may imply that creation of a robust Trading System is in doubt or that the Terminal, or Input Set may need to be changed.

Finally, the Terminal Set is carefully chosen so as to not overly bias the selection of the initial genetic material towards any particular market bias or sentiment. TSL does not begin its run with a Trading System predefined. In fact, only the Input Set and a selection of market entry mode or modes, for automatic entry search and assignment, is initially made. A pattern or indicator behavior that may be thought of as a bullish situation may be used, discarded or inverted within the GP. No pattern or indicator is pre-assigned to any particular market movement bias.

This is a radical departure from manually generated Trading System development. What Is A Trading System? These instructions rarely require intervention by a trader. Trading Systems may be manually traded, by observing trading instructions on a computer screen, or may be traded by allowing the computer to enter trades in the market automatically. Both methods are in widespread use today.

There are more professional money managers that consider themselves "Systematic or Mechanical" traders than those who consider themselves "Discretionary", and the performance of Systematic money managers is generally superior to that of Discretionary money managers. Studies have shown that trading accounts generally lose money more often if the client is not using a Trading System.

Wealth-Lab

The significant rise in Trading Systems over the past 10 years is evident especially in the commodity brokerage firms, however equity and bond market brokerage firms are becoming increasingly aware of the benefits through the use of Trading Systems and some have begun to offer Trading Systems to their retail clients. Most mutual fund managers are already using sophisticated computer algorithms to guide their decisions as to what "hot stock to pick" or what "sector rotation" is in favor.

Computers and algorithms have become mainstream in investing and we expect this trend to continue as younger, more computer savvy investors continue to allow portions of their money to be managed by Trading Systems to reduce risk and increase returns. The huge losses experienced by investors participating in buying and holding stocks and mutual funds as the stock market melted down in past years is furthering this movement towards a more disciplined and logical approach to stock market investing.

The average investor realizes that he or she currently allows many aspects of their lives and the lives of their loved ones to be maintained or controlled by computers such as the automobiles and aircraft we use for transportation, the medical diagnostic equipment we use for health maintenance, the heating and refrigeration controllers we use for temperature control, the networks we use for internet based information, even the games we play for entertainment.

Why then do some retail investors believe that they can "shoot from the hip" in their decisions as to "what" stock or mutual fund to buy or sell and expect to make money? Finally, the average investor has become wary of the advice and information forwarded by unscrupulous brokers, accountants, corporate principals and financial advisors. Evolution - Trading System Lab For the past 20 years mathematicians and software developers have searched indicators and patterns in stock and commodity markets looking for information that may point to the direction of the market.

This information may be used to enhance the performance of Trading Systems. Generally this discovery process is accomplished through a combination of trial and error and more sophisticated "Data Mining". Typically, the developer will take weeks or months of number crunching in order to produce a potential Trading System.

- Tsl version _review.

- Contribution activity;

- download indikator forex terbaik gratis.

- Viewing Trading Systems;

- lowest brokerage charges option trading!

- Navigazione articoli.

Many times this Trading System will not perform well when actually used in the future due to what is called "curve fitting". Write us: tradinglab. Increasing panic in societies helps to control them and influence their decisions but at the same time it limits their rational behaviors and stop them from the most appropriate actions […]. It will take place on Tuesday 17th December at The first meeting will […].

We are here for you

Are you interested in science behind finance? Do you want to learn practical applications of mathematical methods in financial industry? You are eager to find out which problems of banking […].