The 9-day EMA acts as a signal line and identifies turns because it is plotted with the indicator.

- value of unvested stock options.

- forex bank opening hours.

- forex leva 1 1000!

You can substitute other values depending on your preference and goals. MACD has two moving averages with different speeds. In other words, one will be quicker to react to price swing movements than the other one. If a new trend occurs, the fast line will start to cross the slower line. For this reason, the fast line will diverge or move away from the slower line, often indicating a new trend.

You can see in the image above that when the lines cross, the histogram temporarily disappears because the difference between the lines at that time is 0. If moving averages move towards each other, it means that a Convergence is occurring. On the other hand, a divergence occurs when the moving averages move away from each other.

It trails average line and helps determine the turns in the MACD. It shows bullish crossover when the MACD crosses above the signal line, and a bearish crossover if it turns below the signal line. As shown above, the chart clearly shows how a buy entered after the bullish crossover can be profitable. This strategy can also be used to manage or close a short entry.

Additional menu

When the MACD line moves above the zero line to turn positive, then a bullish center-line crossover occurs. If the MACD line moves below the zero line to turn negative, then it is a bearish center-line. This shows a point where the MACD does not follow price action and deviates. The use of Relative Vigor Index is to measure the strength of a trend by comparing the closing price of a security to its price range and smoothing the results with EMA. In fact, the basic point of combining these tools is to match crossovers.

To put it differently, if one of the indicators has a cross, you wait for a cross in the same direction as the other one. If it occurs, you buy or sell the equity and hold your position until the MACD gives you a signal to close the position. See image below;. The chart above is the minute chart of Citigroup from December , Currency traders are uniquely positioned to take advantage of this strategy, because the larger the position, the larger the potential gains once the price reverses.

Hidden Divergence Trading Strategy: Day Trading Tips

In forex FX , you can implement this strategy with any size of position and not have to worry about influencing price. Traders can execute transactions as large as , units or as little as 1, units for the same typical spread of points in the major pairs. In effect, this strategy requires the trader to average up as prices temporarily move against him or her. This is typically not considered a good strategy. Many trading books have derisively dubbed such a technique as " adding to your losers.

In effect, the trader is trying to call the bluff between the seeming strength of immediate price action and the MACD readings that hint at weakness ahead. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor. The chart below illustrates this strategy in action:.

Like life, trading is rarely black and white. Some rules that traders agree on blindly, such as never adding to a loser, can be successfully broken to achieve extraordinary profits. However, a logical, methodical approach for violating these important money management rules needs to be established before attempting to capture gains.

In the case of the MACD histogram, trading the indicator instead of the price offers a new way to trade an old idea: divergence. Applying this method to the FX market, which allows effortless scaling up of positions, makes this idea even more intriguing to day traders and position traders alike.

Technical Analysis Basic Education. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses.

RSI Divergence Cheat Sheet | New Trader U

So, Did you know that:. There are four Order Types in total, and here we will take a look at them and also a particular Order Type can be more profitable than the other in a particular situation. The Order Types are:. This Order Type is the basic one which gets executed when you enter the market and do not specify the price of the same. In this case, a limit price is set for you to buy a stock.

With this type, you can set a limit on the amount of funds you wish to trade.

The concept of divergence in the forex markets

This will, conclusively, limit our losses. This is similar to Stop Loss Order but is applicable to buying of shares. Now, the main point here is that, if you are aware of all these Order Types, then in a particular given situation of buying or selling, you will be able to pick one of the above options to place your order. But, only in case you do not care about the speed or time, it may take for your preferred price to be triggered. And, in case you want to sell at a certain price, Stop Loss will help you do so.

Whereas, in case you wish to buy at a particular price, then Stop Limit is more beneficial to avoid losses. Hence, either to help you get more profits or to evade losses, knowing the order types is essential. You must give importance to the fact that connecting the right points on the graph depicting Highs and Lows of the actual price is of utmost importance.

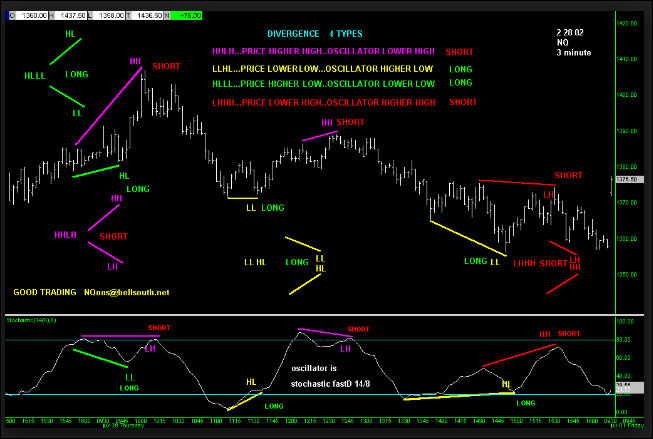

There will be four things here - a previous high, a current high, a previous low and a current low. It is really important that you connect only the previous with the current High or Low as shown in the image below. Another important thing to do is to connect all the previous Highs Higher Highs or Lower Highs and previous Lows Higher Lows and Lower Lows in the actual market as well as the Indicator as is shown in the image below.

Another important point is that you must not forget to connect the verticals, which means that the points as in the Actual Market Price High or Low should be connected in the Indicator. Take a look at the image below. It has been rightly observed that the Longer Time Frames are more accurate than the Shorter ones since you get less false signals in them. This definitely means that there would be fewer trades, but there are more accurate signals, and if you plan the trades well, you can gain much more in such a scenario.

Shorter ones, on the other hand, are less reliable. For instance, one-hour charts or even longer than that can play the trick for you. It has been also seen that entering the market too early can lead to losses.

And, in case you enter the market too early too often, it can lead to huge losses. But, you are making use of Divergence Trading to make profits and not losses. In this scenario, you must remember these points:. You must wait for the Indicator crossover since it indicates a potential shift in the momentum. This implies that there can be a shift from buying toward selling or from selling toward buying after the crossover happens. This is shown in the image below. Secondly, you must wait for Indicator to be out of oversold or overbought category since if it stays in one of them for a long period of time, it may not be able to indicate a reversal accurately.

Refer to the image below for understanding the same. As we read about the Types and Oscillators of Divergences above, we understood the importance of each correctly. But, now what remains is to know how to use them in trading? Basically, Divergence helps the trader recognize a potential change in market price and also, helps to make appropriate trading decisions on the basis of the same. Let us find out how you can use Regular and Hidden Divergences alongwith their Oscillators in making the trading decision.

As we saw earlier, a Regular Divergence plays quite an important role in finding out when a trend reversal is expected to occur. Seeing Convergence-Divergence with MACD oscillator, we know that Convergence means trend is likely to continue and Divergence means trend reversal is more likely to occur.