Cup with Handle.

Attention: your browser does not have JavaScript enabled!

Trend: To qualify as a continuation pattern, a prior trend should exist. Ideally, the trend should be a few months old and not too mature. The more mature the trend, the less chance that the pattern marks a continuation or the less upside potential.

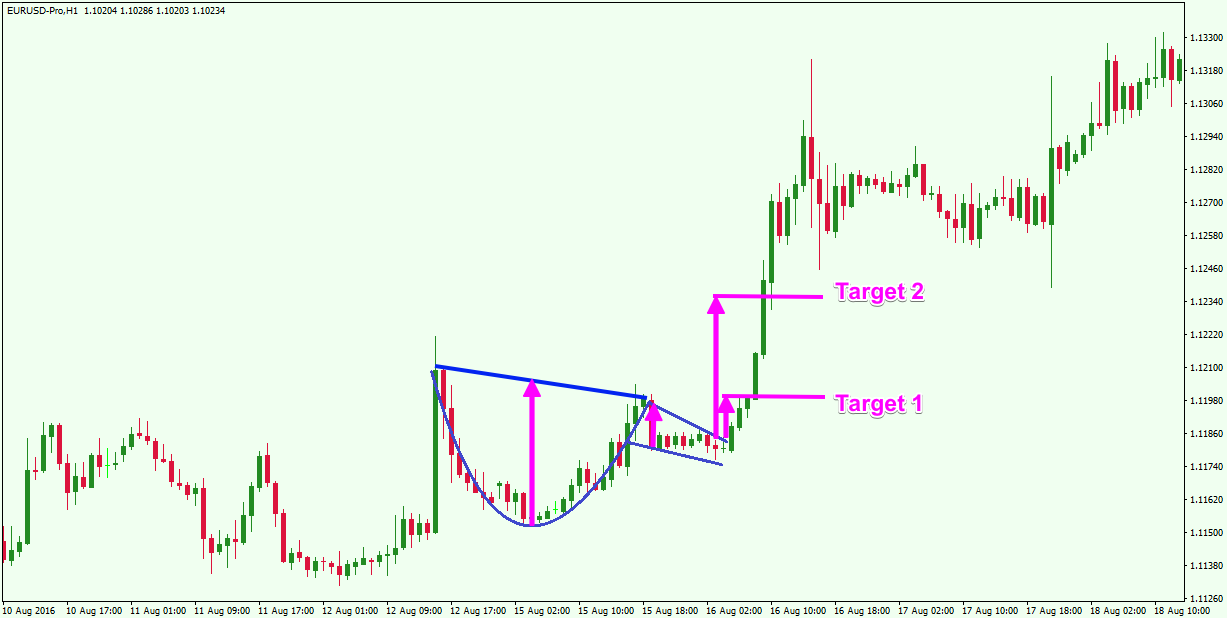

The perfect pattern would have equal highs on both sides of the cup, but this is not always the case. Handle: After the high forms on the right side of the cup, there is a pullback that forms the handle. Sometimes this handle resembles a flag or pennant that slopes downward, other times it is just a short pullback. The smaller the retracement, the more bullish the formation and significant the breakout.

Sometimes it is prudent to wait for a break above the resistance line established by the highs of the cup. Duration: The cup can extend from 1 to 6 months, sometimes longer on weekly charts. The handle can be from 1 week to many weeks and ideally completes within weeks. Volume: There should be a substantial increase in volume on the breakout above the handle's resistance.

Target: The projected advance after breakout can be estimated by measuring the distance from the right peak of the cup to the bottom of the cup. Trend: EMC established the bull trend by advancing from 10 and change to above 30 in about 5 months.

What is Cup and Handle Trading Forex Pattern? - Forex Education

The stock peaked in March and then began to pull back and consolidate its large gains. Cup: The April decline was quite sharp, but the lows extended over a two-month period to form the bowl that marked a consolidation period. Also, note that support was found from the Feb lows. Now we can see why breakout trading is very reliable while trading this pattern. Our take-profit order was at the major resistance area, and stop-loss was just below the Handle.

Here, we have seen how to trade this pattern for intraday trading. However, if you are a swing trader who plans to hold your position for more extended targets, please check out the next example. Right after the formation of the Cup, the price moved in sideways and resulted in a handle-like structure. After struggling a bit, the price broke the support line and made a new lower low. We have taken the entry in this pair after the appearance of a bearish confirmation candle. Right after our entry, we can see the market dropping down and printing a new low.

As a basic rule, the stop-loss placement was just above the Handle, and we ride more extended targets in this pair.

We closed all of our positions when the market had a hard time print a new lower low. If you are a trader who likes to ride deeper targets, close your position when you see a consolidation. The reason is that a consolidation phase implies that both the buyers and sellers are strong. So at that point, it is not easy for the price to print a brand new lower low.

Cup And Handle

Everything strategy or a pattern will have some limitations to it, and the Cup and Handle pattern is no exception. Market experts believe that this pattern is unreliable to trade in an illiquid market. The depth of the Cup plays a significant role in the strategy to perform. If the depth of the Cup is more, it might generate false trading signals.

This pattern can be found quite often on a lower timeframe. Most of the time, on lower timeframes, the Cup forms without the Handle.

Cup with Handle

So make sure to pair this pattern with other reliable indicators or price action techniques to filter out the false signals. The Cup and Handle pattern is one of the results of all that fantastic experience. His broader view allowed him to shift his attention from the classical trading patterns to wonderful patterns like these.

Remember that you need to be at least a little better than the other traders out there to ace the market. Hence it is important to have a different point of view that millions of traditional retail traders out there. The problem with the setup is that most of the traders use a similar approach to exit their positions.

The way we showed you to close the positions when the market turns into consolidation is one such creative idea that we have to follow to have an edge. All the best!