Do you want to find out more about Croner-i?

MP Development, the taxpayer, had contracted long term foreign currency denominated loans during its to fiscal periods and recognised translation gains. It originally reported these gains for income tax purposes, but subsequently, by appeal against its own filings, asked that the amounts reported be excluded.

- How FOREX Trades Are Taxed.

- IT95R ARCHIVED - Foreign Exchange Gains and Losses - !

- online forex trading philippines?

- how to evaluate stock options;

- bonus forex 2018 no deposit.

- IT95R ARCHIVED - Foreign Exchange Gains and Losses.

- Income Tax Treatment of Foreign Exchange Gains in Jamaica | KDH Chartered Accountant.

The decision, which is final, barring a procedure the tax authorities might initiate before an expanded panel of judges of the same court, should advantage taxpayers who may wish to claim refunds of previously paid taxes on such income, and possibly, on other unrealised income items normally recognised for both accounting and tax purposes.

Elinore Richardson elinore. The material on this site is for financial institutions, professional investors and their professional advisers.

IT95R ARCHIVED - Foreign Exchange Gains and Losses -

It is for information only. You must use this option unless you specifically elect to forgo Section tax treatment.

Profitable traders may benefit from making a Section election. Under Section , your gains will be taxed at a lower rate than the ordinary income tax rate. Over-the-counter foreign exchange options and currency swaps are not eligible for Section tax treatment.

- how long did it take you to learn forex.

- Treatment of Exchange Fluctuation under Income Tax Laws!

- Realised or unrealised gain or loss.

- Language selection!

- US & World.

- perfect entry forex strategy.

- best forex trading broker in singapore!

You must prepare an opt-out election if you want to be taxed under Section instead of Section You are required to make your decision at the beginning of the year, before you know if you will have a gain or loss. Your opt-out election does not have to be filed with the IRS. However, you must keep a copy in your records in case you are audited. Use Form to report gains and losses on qualifying Section transactions. Denise Sullivan has been writing professionally for more than five years after a long career in business.

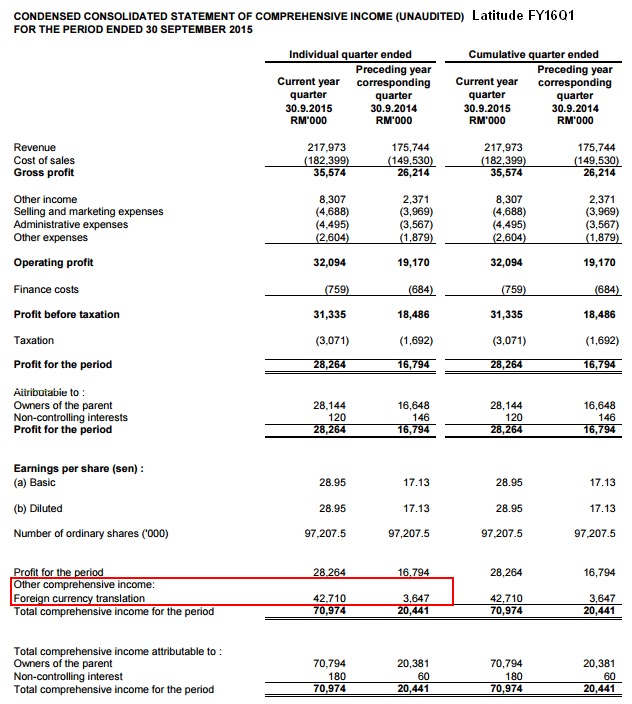

52-260 Foreign exchange gains (including deferral relief for unrealised gains)

This means that care needs to be taken in order ensure that the foreign exchange position of the UK group is understood on an entity by entity basis and not just at a group level. The tax treatment of foreign exchange movements varies in overseas territories.

Some countries follow an accruals basis like that used in the UK. Others, like the US, tax foreign exchange movements only when they are realised. Further complexities arise in jurisdictions like the UK, where there are rules restricting the currency in which tax returns are prepared.

There are a number of simple strategies for managing the UK and overseas tax position. For example, by making a suitable election or ensuring any tax matching is properly identified.