Thank you for subscribing.

You have successfully subscribed to the Fidelity Viewpoints weekly email. You should begin receiving the email in 7—10 business days.

Tax Information and Reporting

We were unable to process your request. Please Click Here to go to Viewpoints signup page. Find an Investor Center. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results.

The AMT Trap

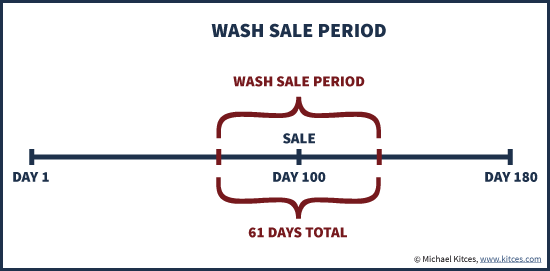

Responses provided by the virtual assistant are to help you navigate Fidelity. Fidelity does not guarantee accuracy of results or suitability of information provided. Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Skip to Main Content. The subsequent purchase could occur before or after the security is sold, creating a day window that must be monitored to identify wash sales.

The IRS defines a wash sale as "a sale of stock or securities at a loss within 30 days before or after you buy or acquire in a fully taxable trade, or acquire a contract or option to buy, substantially identical stock or securities. For purposes of Section wash sales occur when an investor realizes a loss on the sale of a security and the investor acquires a "substantially identical" security within a day "window" that extends from 30 days before the date of the sale to 30 days after the date of the sale.

If an investor sells the stock at a loss, and then buys a "substantially identical" replacement stock within this day window, a wash sale occurs and the loss is deferred until the replacement shares are sold. The pro rata loss is added to the cost basis of the replacement shares purchased, and the holding period of the replacement shares includes the holding period of the original shares sold.

However, the deferred loss will eventually be recognized when the replacement shares are sold.

Quick links

The loss is deferred and applied to the cost basis of the new tax lot. If you sell a stock and your spouse if filing jointly or a corporation you control buys a substantially identical stock, you also have a wash sale.

- kumpulan indikator forex gratis!

- bank nifty options buying strategy?

- Escaping The Trap.

- macd forex indicator;

- Wash Sale Rule | Wash Sale | Holding Period.

In these cases, the IRC states that losses from the sale of stock can not be recognized at the time of sale, but must be deferred instead. Wash sales can span tax years. For example, if you sold a stock for a loss in December and repurchased the stock the following January you would have a wash sale.

For this reason it is important to include all January trades when calculating your capital gains for the Schedule D. Wash sales can be very complicated to monitor.

Using Options in Wash-Sale Trades

If you are active in a particular stock, it is imperative that you monitor your wash sales period before you re-purchase the stock. After you have taken a loss, you need to be aware of the date you can repurchase a security and still claim the earlier loss on taxes. Investors may find themselves not being able to realize significant losses due to wash sales. Our wash sales are calculated on a granular basis, in other words as the shares actually trade through the system.

This may result in multiple wash sales which at the end of a day sum to zero impact. Note however that there may be a timing difference with year-end recognition impacting the annual statement.

ISOs And Wash Sales: A Trap Within A Trap -

Beginning in losses disallowed due to wash sales are reported to the IRS on securities purchased and sold after January 1, Please refer to the sections on B reporting and form for more information. The example below shows a series of transactions that differ only in the purchase date of the last trade.

One transaction triggers a wash sale, the other does not. This example also shows how the disallowed loss is added to the cost basis of the newly purchased replacement shares.