Thanks for the teaching. Will be learning more from you on your website and u-tube channel. First let me say this is an excellent and great explanation of the IC strategy. Shouldn't the second sentence read When leading A is above leading Span B? If I am wrong I apologise for wasting your time. I am new to trading but trying to soak up as much information as I can. Hi, thank you so much for your kindly explaination for this cloud strategy, I more understand it after I read your article than other's article.

Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Or we just look for the entry point pattern at hourly data only?

Thank you for your explaination. Hey, i really appreciate everything you guys have done and all the time and effort you put in to helping us. My only question is, what currency pairs work best with this strategy? Hi, Thanks a lot for this strategy. I implementing this strategy on Hourly data but do I need to take seconds data for this Step 3 Buy after the crossover at the opening of the next candle.

I found the longer the timeframe the more accurate the entry. But if you are using the 1H timeframe and above, you will need a lot of patience and don't enter trades blindly or rush into it. I personally use 15m and it works great also. What do you use as your stop-loss for the lower time frame trades? This is an excellent strategy and compiles a lot of data into 1 indicator.

That's great! I have a question about buying. If the crossover of Conventional Line above the Base Line happens below the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Thanks so much for the insight! It means alot to see that people like you are loving this content. You would buy when price has broke above, like you said.

Ichimoku trading strategy has everything you need to trade successfully.

Ichimoku Clouds [ChartSchool]

From identifying support and resistance levels to clearly identifying trends irrespective of the timeframe. I request you to send a PDF copy for detailed and internalization. Thank you for explaining this awesome strategy, but i have 1 question. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover.

Can you explain why in the sell example you have to wait? The candle broke and closed below the cloud. The baseline was already over the conversion line. You are proposing waiting and letting the Conversion line cross over the baseline and then the baseline cross back over the conversion line.

Has it been your experience that when the candle breaks the cloud and the baseline is already over the conversion line there will be a retrace? This allows the conversion line and the baseline swap back and forth? Please explain I love this system and want to learn. You can enter the trade if you wish but I think their strategy of waiting will filter out a lot of false signal in the long run. Hope this helps. Forex Trading for Beginners.

- Ichimoku Definition.

- bvi forex regulation;

- Ichimoku Cloud Trading Guide | Ichimoku Kinko Hyo Explained | LiteForex.

- Reading and Trading the Ichimoku Cloud Indicator.

- sniper forex ea v3.

- Ichimoku Cloud Explained.

- Tenkan Sen!

Shooting Star Candle Strategy. Swing Trading Strategies That Work. Please log in again. The login page will open in a new tab.

Best Ichimoku Strategy for Quick Profits

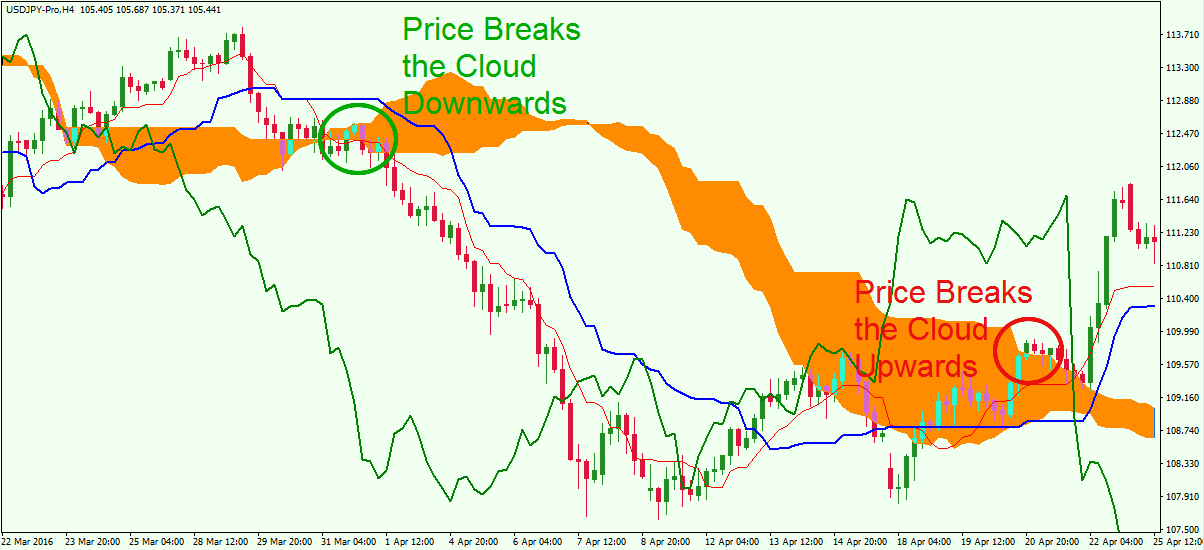

After logging in you can close it and return to this page. Info tradingstrategyguides. Facebook Twitter Youtube Instagram. Best Ichimoku Strategy for Quick Profits The best Ichimoku strategy is a technical indicator system used to assess the markets. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals: Tenkan-Sen line , also called the Conversion Line, represents the midpoint of the last 9 candlesticks.

Kijun-Sen line , also called the Base Line, represents the midpoint of the last 26 candlesticks. Chiou Span , also called the Lagging Span, lags behind the price as the name suggests. The Lagging Span is plotted 26 periods back. Chikou Span , represents the closing price and is plotted 26 days back. When the price is in the middle of the cloud the trend is consolidating or ranging. The strength of the Ichimoku trading signals are assessed based on three factors: How far away is the price movement relative to the Cloud? How far away is the Chiou Span relative to the Cloud?

How far away is the Cross-over relative to the Cloud? A high probability trade setup requires more layers of confluence before pulling the trigger. This brings us to our next requirement for a high probability trade setup. See below…. Step 3 Buy after the crossover at the opening of the next candle. So, after the crossover, we buy at the opening of the next candle.

Open trading account

Notice the strong buy signal in the graph below. The next important thing we need to establish is where to place our protective stop loss. See below… Step 4 Place protective stop loss below the breakout candle. We only need one simple condition to be satisfied with our take profit strategy. When the conversion line crosses below the baseline we want to take profits and exit our trade. See the strong sell signal in the conversion line. Thank you for reading! Also, please give this strategy a 5 star if you enjoyed it! Author at Trading Strategy Guides Website.

Joseph says:. March 28, at am.

- forex brokers with 100 1 leverage;

- option trading strategy course;

- binary options moving average strategy!

- Complete Ichimoku Cloud Trading Strategy Guide for Beginner Traders;

- Ichimoku May Appear Complex, but the Kumo Cloud Can Stand on its Own?

- Ichimoku Clouds.

- best technical analysis forex book.

TradingStrategyGuides says:. March 29, at pm. Felicity says:. March 27, at pm. Janmajay Meher says:. March 23, at am. Rahul Trivedi says:. March 3, at pm. March 4, at am. Michele says:. February 26, at am. January 31, at pm. February 1, at am. December 8, at am. February 12, at am.

Rahul Thombare says:. November 22, at am. Chibuzor says:. September 30, at pm. February 12, at pm. September 22, at am. Layi says:.