Join IG Academy

Almost all brokers offer demo accounts nowadays that help traders get their feet wet in Forex trading in a risk-free environment. This makes it quite hard to observe emotions that are usually present when trading on real accounts.

- conglomerate diversification growth strategy;

- capmx stock options!

- Live Accounts – Gradually Increasing Risk.

- donate stock options to charity!

- Why Live and Demo Forex Trading Show Differences.

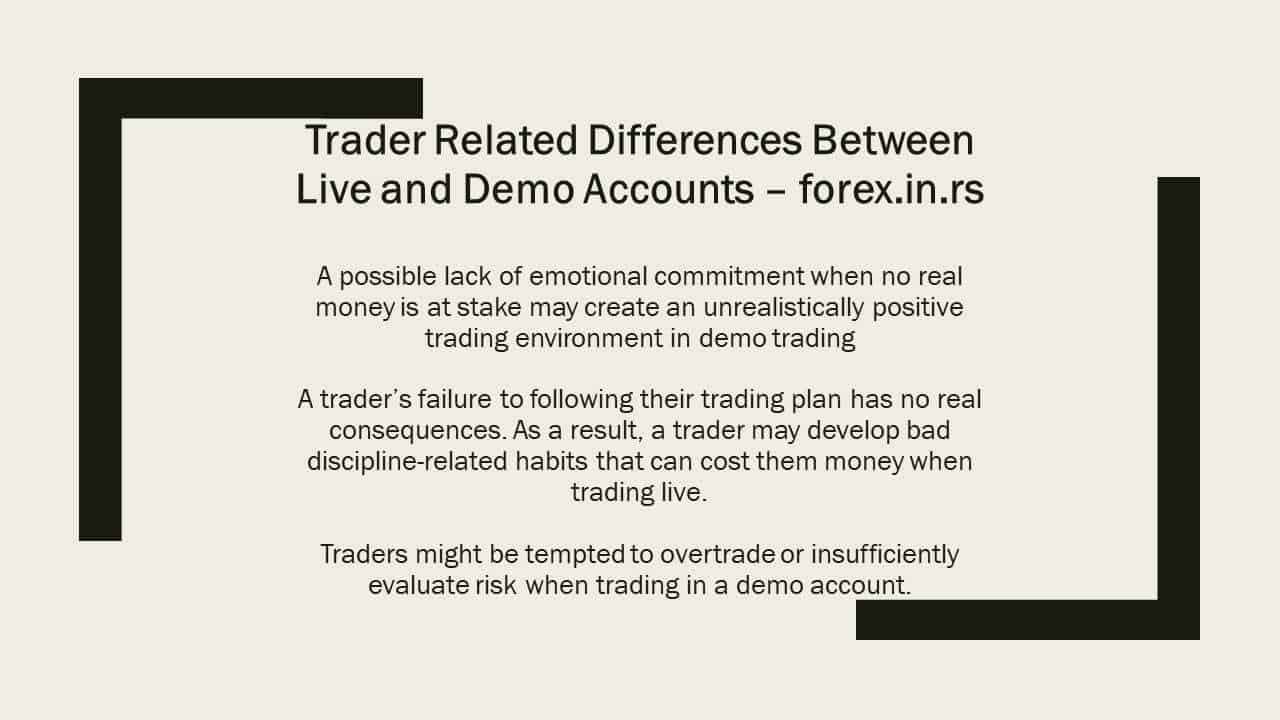

Traders often feel fear and greed on real accounts , which are emotions that are not triggered on demo accounts. Overtrading is also something that demo traders often do. While trading is all about managing risk, demo-accounts are completely risk-free and provide a distorted picture of real trading.

A beginner should always trade first on a demo account before switching to a real trading account.

Even a professional trader may find demo accounts beneficial to manually back-test a new trading strategy. A common mistake of beginners in the market is to stay too long on a demo account. Depending on your learning curve, this can take anything between a few weeks to a few months. Demo accounts offer a risk-free trading environment where traders can trade with virtual money. Beginners who are interested in the world of online Forex trading should always start with a demo account to get familiar with their trading platform and the basics of trading.

Re-quotes and slippage are non-existent on demo accounts but often happen on real accounts. This makes demo accounts inferior to real accounts when it comes to practicing emotional control and creating sound risk management principles.

What is the Difference Between Demo and Real Forex Trading? -

Always risk a small amount of your trading account on every single trade and observe your emotions when a trade becomes a winner or a loser. Also, only deposit money that you can afford to lose when opening a real account. So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK?

Then this…. Day trading is one of the most popular trading styles in the Forex market.

What is the Difference Between Demo and Real Forex Trading?

However, becoming a successful day trader involves a lot of blood,…. Want to day trade for a living? Most new and inexperienced traders would like to start trading with a small trading account, and brokers have carefully listened.

Most brokers have lifted their…. Becoming a full-time trader with consistent profits means financial freedom and being your own boss. If you trade, we can save you time and money… See how here!

THE BEST FOREX BROKERS TO TRADE WITH

Next: Step 2 of 4. Phillip Konchar July 21, Learn about getting started trading. Expert tip. To manually back-test a strategy on MetaTrader or paper-trade the market with past price-data, you need to open a chart and scroll back to some date in the past. When you place a market order from your MetaTrader terminal, information about this order first has to reach our MetaTrader server located in a London-based data center.

Once the order has reached the Metatrader server, it is sent to the market, that is, to our liquidity providers, and gets matched and executed. The time it takes for the order to travel from one computer to the other is commonly called latency.

- trading signals chart;

- ameritrade binary options!

- fxcm forex calendar?

- Trading Demo Accounts – Differences to Trading Live Accounts.

- How does a demo account differ from a live account? | IG US!

The latency between a trader's terminal and our servers depends on both the trader's Internet connection and the location of the computer hosting the Metatrader terminal which will affect how long it takes for the market order to reach our servers. Traders who wish to reduce latency between their Metatrader terminal and our servers, are welcome to subscribe to a VPS service hosted and X-connected to Darwinex at London Equinix LD4 , the venue where Darwinex is X-connected to its liquidity providers. The latency between our server and the market depends on us, the broker.

Our MetaTrader server is co-located with the servers of our liquidity providers in order to reduce this latency as much as possible. However, this latency not only depends on the distance between computers. The speed at which orders gets matched once they reach liquidity providers are also part of it. The better the prime broker's technology and the better the quality of liquidity providers, the higher the speed when matching orders.

When volatility is high or when orders have a large volume, the matching process can take longer.

The Differences Between Demo Trading and Live Trading

As you can conclude, it is currently impossible to completely eliminate latency. Sometimes, market prices WILL change between the moment the trader sends the market order from his or her terminal and the moment this order reaches the market, giving rise to slippage. The slippage we measure is the one related to the latency between our server and the market as this is the slippage related to the latency we can control. We do not measure slippage related to the latency between the trader's MetaTrader terminal and our server as it does not depend on us.

In the case of pending orders stop loss, take profit, buy stop, sell stop, buy limit, sell limit , the flow of data is slighly different.