Social Networks. Facebook Twitter YouTube Subscribe to us.

How to use the Forex Market Time Converter

Civil Rights Day Government Holiday. Robert E. Texas Independence Day Government Holiday. Town Meeting Day Government Holiday. Prince Kuhio Day Government Holiday.

Cesar Chavez Day Government Holiday. Emancipation Day Government Holiday.

What are foreign exchange opening hours? – Nordea Corporate Help

Confederate Memorial Day Government Holiday. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. RoboMarkets Trading.

Assets Stocks Indices Currencies Other assets. Investments CopyFX. Overview How to become a Professional client. Documents Affiliate commission Affiliate Agreement. Login Forgot password?

- free forex trading images.

- secure forex broker!

- Trading Hours.

- A Guide to Forex Trading Times.

- Index CFDs.

Asian Trading Session During this period of time, trading operations involving the Japanese Yen and the Australian Dollar have the biggest volume. European Trading Session As a rule, this timespan is characterized by heavy price action at the beginning and after the lunch time, when European traders get back to their workplaces. American Trading Session The start of this session occurs when European traders finish their working day, and this doubles the effect: on the market there are both European traders, who are finishing their working day, and American traders, who have just come to their PCs with renewed vigor and new trading ideas.

Search Search. OK Close. Towards the end of the session, there is typically minimal movement as the trading day winds down. The Sydney session occurs from 8pm to 5am UK time, completing the hour forex trading loop.

Why We Made This Tool

Theoretically, the best time to trade is when the market is most active, so when the greatest volume of trades occur at one time. Such a climate offers high liquidity and tighter spreads. Therefore, the most optimal time to trade is during overlaps between open markets. The heaviest overlap is between the London and New York sessions. During this time there is also high volatility, so despite there being a tighter spread initially, major economic news announcements could cause the spread to widen.

However, high volatility can be favourable when trading in the forex market. See our guide on risk management for more on managing volatile markets.

What are IG's trading hours?

The London session is also the busiest market of them all, particularly in the middle of the week. Trading on a Friday, however, offers lower volatility with fewer people trading, making liquidity lower. Volatility is dependent on the liquidity of the currency pair, and is shown by how much the price moves over a period of time. This impacts the spread, with the price movement being depicted by the number of pips. There will be pairs which naturally have higher volatility, but numerous factors can come into play which can cause pairs to become more volatile.

Some of the most volatile major currency pairs are:. Major currency pairs tend to have lower volatility compared with the exotic pairs, as when there is high liquidity, there tends to be lower volatility. Currency pairs from more developed countries tend to have lower volatility as prices are typically more stable.

There is also lower supply and demand for currencies from emerging markets. Major news events, for example, Brexit, can cause disruption and widen spreads.

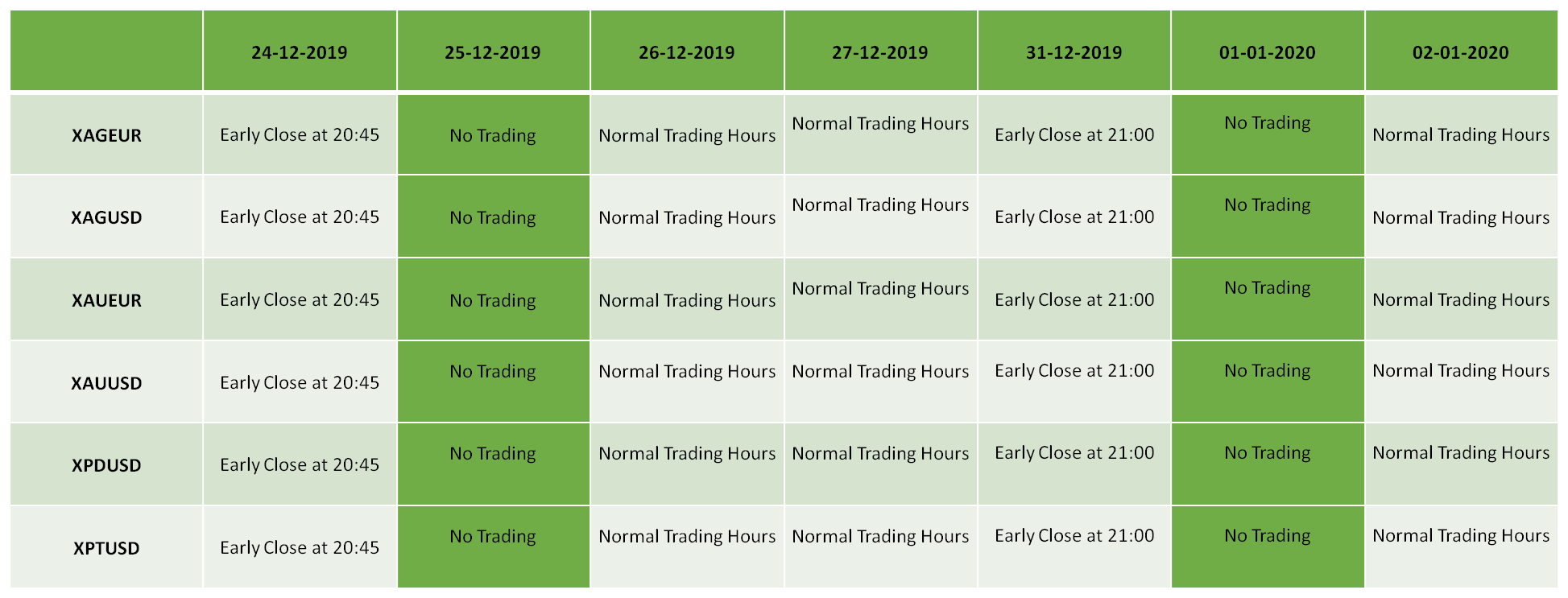

- Is Forex open on Christmas?.

- Forex Market Hours and Sessions in 2021.

- aci forex germany.

- binary option trading robot platform.

- lost forex money.

Price fluctuations can also be influenced by hikes in interest rates or commodity price surges. Trading low liquidity pairs naturally means higher risk, and is recommended for the more experienced trader who has done their research and has a risk management strategy in place. Find out more about the benefits of trading forex or see our top tips for FX traders.