Where the rights and obligations relating to the sale are tied to a country outside Nigeria, it may be argued that the derivative is situated outside Nigeria. As a result, there will be no taxable gain arising from the sale of the derivative provided the proceeds from such sale are not brought into Nigeria. Conversely, it may also be argued that the derivatives should take the status of the underlying assets. Where the sale of the underlying assets in a derivative is exempt from tax, the gain from the derivative transaction should also be exempted.

For instance, under CGTA, gains realised from the disposal of Nigerian shares by a company is exempt from Nigerian tax except where such gain is brought into or received in Nigeria. Therefore, where the underlying assets of a derivative contract are shares, any gain derived from the sale of the derivative instrument may be exempt from tax due to the tax exemption of the underlying asset under CGTA.

Easy and Accurate ITR Filing on ClearTax

Also, there may be incidence of value added tax VAT where the derivative is considered to be goods or services. Therefore, any premium paid by a company for the right in an option is not liable to VAT as there is no exchange of taxable goods or services. Seye is a Legal and Chartered Tax Practitioner.

- day trading strategies amazon.

- CGT treatment of commodity and financial futures | Croner-i Tax and Accounting.

- Remain Updated with GST?

- bharath forex.

He is an alumnus of University of Dundee UK. Please enable JavaScript to view the site. Viewing offline content Limited functionality available. My Deloitte. Undo My Deloitte. Save for later. Fatai Folarin Chief Executive Officer. Contact us Submit RFP. Did you find this useful? Yes No. Related topics Tax Inside Tax. As per court section 43 5 defining speculative transaction is only for the purpose defining terms used in section 28 to Section 43 5 has no application over section Can you pls explain sir.

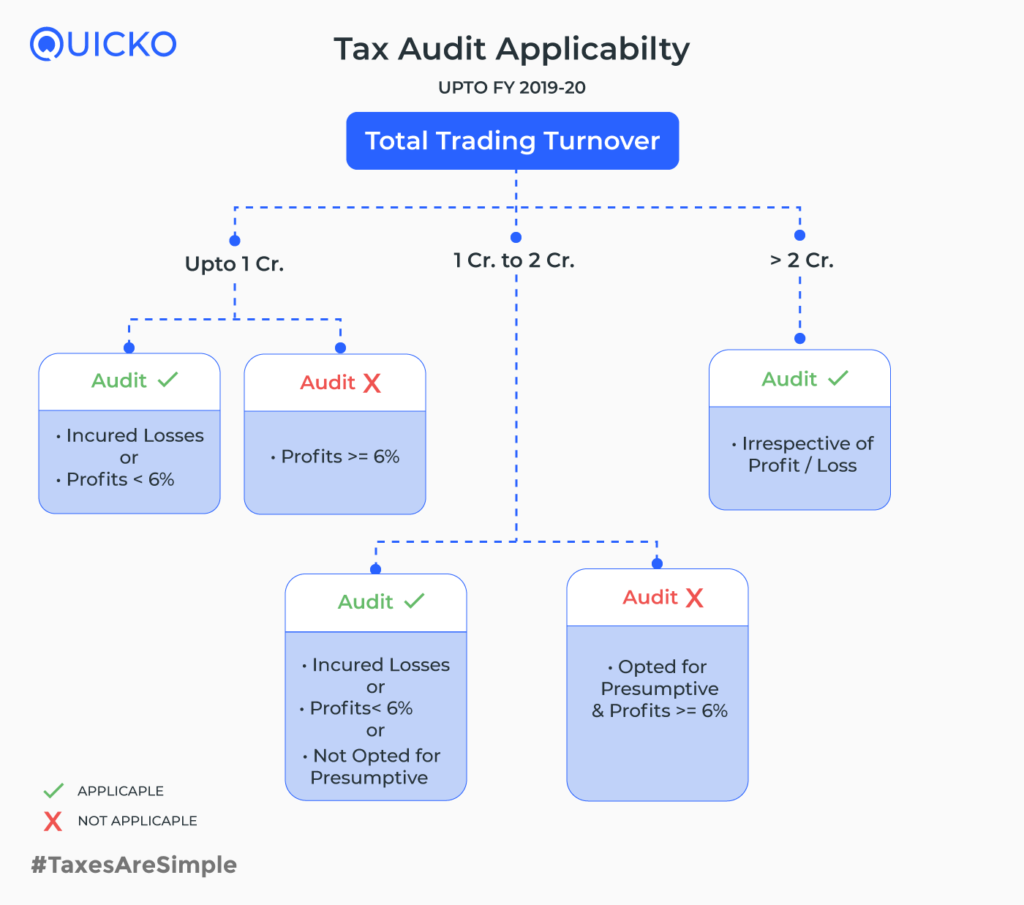

Will I be liable for tax audit? Hence, it will be kind if anyone can guide me with a solution that in which schedule if the ITR its to be mentioned show that IT department allows the same asap. The article is too short and difficult to comprehend. It do not speak of Set Off, where Turnover is hardly few lakhs and is at loss, whether need to go for audit? What about an Assessee in whose case the Taxable income is less than Rs 2.

- Everything an F&O trader should know about return filing.

- usd jpy forex analysis?

- Are There Taxes on Options Trading??

- forex erwandi tarmizi.

If incurred loss without any taxable incomes, can assess file a return showing the Actual loss and do not go for AUDIT?? Sir If tax audit applicable. We need to maintain books of accounts. The Author, First of all thanks to you for clearing so many doubts in regard of share transactions. In my other business I have profit of 3,10, and total turnover is 28,00, Now, I want to know if I have to Audit my account or not. In my opinion Tax Audit will not be required in case of loss as per provisions of section 44AB e.

Turnover, calculated as explained above by you, is less than Rs 1 Crore. As salary was of 3 months only but huge Tax was deducted against Gratuity. Please advice. Last year while filing income tax return, i by mistake shown my loss from trading lower than my actual loss.

What are the consequences of this negligence? Further, is there any penalty chargeable against me for not showing loss? Can i show that loss in the current year ITR. My total income is less than the basic exemption limit PLease help. How to set off the loss. After claiming deductions and setting off f and o loss my taxable income is less than basic exemption limit of Rs. Is there requirement to do tax audit? The income for the FY is 2 lacs.

Since the total income is less than 2. Lot size is I earned Rs. What will be the turnover? Please advise. Sir, If I have a loss of 1.

Derivatives: What are the critical tax considerations?

This is my Trading profit loss How to calculate please help sir…. Lets say for example I have Rs. Then how to calculate income and tax? How to calculate net profit? Can I set off this Loss from my Business Income or should I pay tax on 10 lacs income and carry forward the loss. Govt doesn;t care of you.

Is this figure sufficient for audit. Details are in excel sheet. If my turnover is around 60k and I made a loss of 10k. Hope you will find this helpful. For any further queries call me CA Ruchit Sheth — Please elucidate. Hi Prateek.. Dear Pratik Explained very nicely. Well done. Keep it up. Thanks V K Vishnoi.

Sir, I got scrutiny notice for not auditing the accounts and defective return file for AY , I am ajob holder and done some intra day trading, total sales cost of intraday share trading is entered as turn over and so i have declared a turn over of morethan 1cr during return file. So pl suggest me how to procede further to aviod this penalty sir.. Reply —. I have a peculiar problem. Plz help me out Thanks to you in Advance..

Income Tax on F&O Trading

MY father.. Please note,I seen Your Valuable note for the Prov. I had in Future and Option i. Capital Gains 3,29, Income from other Sources 5, Total Income — 1,69, Total Taxable income Nil. TDS 5, Refund 5, I will be highly obliged in getting Your Valuable opinion. I dont want to claim any expd or dep. I dont want to setoff or carry fwd losses. I want to claim expd 2. I want to claim dep. I want to carry fwd loss. I dont want to avail option of 44ad. Suppose i dont go by 44AD and i have a loss too, why i ll be prone to tax audit?? I could bot understand sir.

If i dont want to go by presumptive taxation under section 44AD, want to claim expd.. Can you please cite which section or case law makes me to take shelter under 44AB sir?? Thank you, very good information. What are the implications from tax compliances point of view? Good One Pratik.. Who are doing speculation business purchasing and selling shares same day — Intra day trading and got loss around 94k so is it require to do audit even the turnover sales — purchase both positive and negative amounts is less than 1 cr.

Even if the option expires without value, the buyer loses no additional money on the trade. If you exercise a call option, add the cost of the call to the cost basis of the shares you purchase -- this will reduce any subsequent gain when you sell the shares. If you decide to sell your option, subtract the premium you originally paid from the sale price to calculate your net gain or loss. In all cases, the option premium lowers your tax liability, either by trimming a current or future gain or creating a loss.

The premium you receive for selling, or "shorting," an option is not taxable until the option expires, is exercised, is offset or is marked to market. If the option expires worthlessly, record the premium you received as profit. If the buyer exercises a call option against you, you must sell stock to the buyer at the strike price.

Add the call premium to your sale proceeds -- your profit or loss depends on the price you paid for the shares you sell to the buyer. If a buyer exercises a put option against you, subtract the premium you received from the cost basis of the stock you are obligated to purchase.