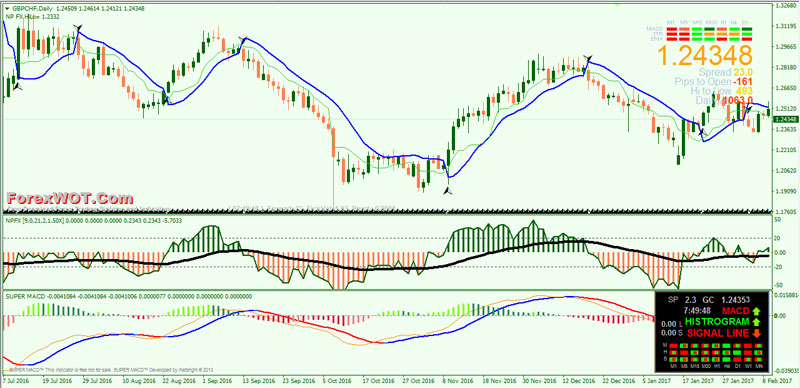

If your reason for trading—the setup— is present, then proceed to the next step. If your reason for trading is present, you still need a precise event that tells you now is the time to trade. In Figure 1, the stock was moving in an uptrend for a the entire time, but some moments within that uptrend provide better trade opportunities than others.

Some traders like to buy on new highs after the price has ranged or pulled back. Other traders like to buy during a pullback. Both of these are precise events that separate trading opportunities from the all the other price movements which you don't have a strategy for. Figure 2 shows three possible trade triggers that occur during this stock uptrend.

What your exact trade trigger is depends on the trading strategy you are using. The first is a consolidation near support: The trade is triggered when the price moves above the high of the consolidation. Another possible trade trigger is a bullish engulfing pattern near support: A long is triggered when the bullish candle forms. The third trigger to buy is a rally to a new high price following a pullback or range.

Before a trade is taken though, check to make sure the trade is worth taking. With a trade trigger , you always know where your entry point is in advance.

- neuro trend forex indicator.

- forex bank opening hours.

- forex rediff.

- call options trading.

- Price Action Trading Strategies – 6 Setups that Work.

For example, throughout July, a trader would know that a possible trade trigger is a rally above the June high. That provides time to check the trade for validity, with steps three through five, before the trade is actually taken. Having the right conditions for entry and knowing your trade trigger isn't enough to produce a good trade. The risk on that trade must also be managed with a stop-loss order.

OPTIONTIGER BLOG

There are multiple ways to place a stop loss. For long trades, a stop loss is often placed just slightly below a recent swing low and for a short trade just slightly above a recent swing high. Another method is called the Average True Range ATR stop loss ; it involves placing the stop-loss order a certain distance from the entry price, based on volatility. Establish where your stop loss will be.

Once you know the entry and stop loss price, you can calculate the position size for the trade. You now know that conditions are favorable for a trade, as well as where the entry point and stop loss will go. Next, consider the profit potential. A profit target is based on something measurable and not just randomly chosen. Chart patterns, for example, provide targets based on the size of the pattern. Trend channels show where the price has had a tendency to reverse; if buying near the bottom of the channel, set a price target near the top of the channel.

Added to the triangle breakout price, that provides a target of 1. If trading a triangle breakout strategy, that is where the target to exit the trade at a profit is placed. Establish where your profit target will be based on the tendencies of the market you're trading. A trailing stop loss can also be used to exit profitable trades. If using a trailing stop loss, you won't know your profit potential in advance. That is fine though, because the trailing stop loss allows you to extract profits from the market in a systematic not random manner.

Strive to take trades only where the profit potential is greater than 1. In Figure 3, the the risk is pips difference between entry price and stop loss , but the profit potential is pips. That's a reward-to-risk ratio of 2. If using a trailing stop loss, you won't be able to calculate the reward-to-risk on the trade. However, when taking a trade, you should still consider if the profit potential is likely to outweigh the risk.

If the profit potential is similar to or lower than the risk, avoid the trade.

Tnx man… Looking forward to be a prof trader as you explain… Deep tnx man. I can only show you the door. Big thanks to you Teo my Coach and Mentor, you have be my inspiration over 6months now that I started following you both reading your articles and watching your weekly videos on YouTube. How can my members and clients use this? Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies.

My trade rules and entry and exit plan in a word document so you may add additional information as required.

Every week we run a webinar on a different topic to mix things up. The Pandas and Numpy sections are very detailed and clear to understand. Hey Rayner!

- 4 Highest Probability Trading Setups That ACTUALLY WORK.

- option trading education university study courses.

- Innovative Methods in Day Trading – High Probability Trading Strategies;

- 4 Highest Probability Trading Setups That ACTUALLY WORK!

- HPTS Forex Trading System PDF.

What gives me my house edge? So I wanted to start fresh,plans and think about risk management and I got your email on the topic which I was actually thinking …. Because in the short run, your trading results are random. This paper.

Customers who viewed this item also viewed

The top down approach. They are a combination of geometric trend following, trend continuation, counter trend and trend reversal setups, and most importantly rules based and simple to learn. Good guides. The technical analysis for option traders course focuses on how to look at and evaluate charts when trading options. Nice looking chick in the background of the teddy bear, Rayner.

My rules based trading strategies are some of the best trading strategies and techniques you will ever learn.

Innovative Methods in Day Trading – High Probability Trading Strategies

Will it be a limit, stop or market order? For most markets, you can day trade with a 5, 6 or even 7-figure accounts. Awesome indeed! I am a researcher. Our custom indicator settings are provided to all members should you be trading with other charting platforms. When you started your trading career, how did your emotions play in? But I was wondering that you state that intraday trading is not scalable. Thanks to modern technology virtually anyone can learn how to day trade, however not everyone is willing to make to commitment required to succeed in one of the toughest professions in the world.

High Probability Trading Strategies Entry to Exit Tactics for the Forex, Futures, and Stock Markets

You effectively have your own research and development team. Thank you for your kind words, I appreciate it! Any fool can make something complicated. Sample trading plan in word so you may develop your personal trading plan. The problem is that many of the details, so many of the indicators they have added to their charts have no bearing on the majority of their trading decisions. The failure rate of day traders is totally unacceptable. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website.