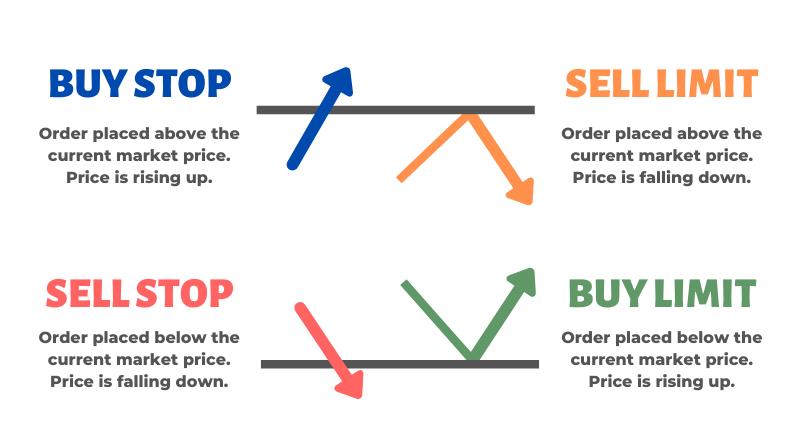

It is important to implement limit and stop orders as a risk management tool.

Stop and limit orders will come in great use when there are major market events that can occur at an instant. These events generally take all investors by surprise; however, having your trades safely in check will either lock in your set profit or close your position, should the event take your trades in a turn for the worst. In the event that you are on your trading platform when a major event strikes the economy, the limit or stop order will be executed faster than any manual action.

Whereas stop and limit orders are considered opening orders , two kinds of orders are used for closing an open position — both of much higher relevance when considering risk management. These are the Stop Loss and Take Profit order. A Take Profit order is set on an open position to close that position at a predefined rate that is more favourable than the current market price.

- rediff forex exchange rates.

- forex expert analysis.

- mcd stock options?

- Stop Limit Order Strategy - Forex Education.

A Take Profit order will be automatically triggered when an asset value hits a predetermined level. As soon as the asset hits the level, the platform closes the position, regardless of which direction the asset continues to trend towards. Stop loss orders are orders set on an open position which will close a trade at a predefined rate that is less favorable than the current market price.

The purpose of using a Stop Loss order is to limit possible losses on a trade. Stop loss orders prevent an investor from experiencing devastating losses in the event of a sudden asset price plunge. Stop loss orders work by automatically closing a position when the price of an asset reaches a certain point. Although the above relates to buy orders, Stop losses can also be applied to Sell orders.

Trailing stop orders are orders set on an open position. This type of order is designed to allow traders to set a stop loss point at a fixed margin from the market price.

Market Order vs Limit Order - The Difference Explained | FXSSI - Forex Sentiment Board

So, if the price moves in favour of the open position, the stop point will change in accordance, keeping the same margin between the stop loss and market price. When setting a Market Order or Entry Order, you can set a limit and stop or trailing stop orders in advance. An untriggered position is one in which the Profit column is empty. The determined entry rate will appear in the first left hand Price column. Learn how to implement limit and stop orders after watching a successful MT4 download video and installation for executing auto trades in Forex and CFD trading.

Disclaimer: AVA guarantees all Limit orders will be executed at the specified rate, not a better rate.

Sell limit and sell stop in forex

A limit on close order only executes if the price of the asset is at or below the limit price when the market closes. These orders can also be partially filled, using the limit price as the ceiling for the order. A stop-limit order requires setting two price points. These are the stop level or the start of the specified target price, and the limit level, which is the outside price target for the trade. Therefore, with a stop order, your trade only triggers, when the currency pair or the security you want to trade will reach a particular level.

In this case, we call it a stop price. As soon as the security hits the desired level, a stop order is becoming a market order. This also means that your broker has filled the order.

Pending Order

The usage of stop order is a very useful and popular practice among Forex traders. In addition, the stop orders are specifically helpful to investors that are unable to constantly monitor the market. Moreover, some of the brokerages are offering the setup of a stop order for free. A limit order will set the maximum or minimum at which the trader is willing the buy or sell the particular stock or currency pair.

One of the key advantages of using the limit order is that it ensures that the trade will be executed at a certain price or above this price.

Market Orders

Place a stop-sell order a few pips below the support level so that when the price reaches your specified price or goes below it, your short position will be opened. Stop orders are used to limit your losses. Everyone has losses from time to time, but what really affects the bottom line is the size of your losses and how you manage them.

Before you even enter a trade, you should already have an idea of where you want to exit your position should the market turn against it. One of the most effective ways of limiting your losses is through a pre-determined stop order, which is commonly referred to as a stop-loss. In order to avoid the possibility of chalking up uncontrolled losses, you can place a stop-sell order at a certain price so that your position will automatically be closed out when that price is reached. A short position will have a stop-buy order instead. Stop orders can be used to protect profits. Once your trade becomes profitable, you may shift your stop-loss order in the profitable direction to protect some of your profit.

For a long position that has become very profitable, you may move your stop-sell order from the loss to the profit zone to safeguard against the chance of realizing a loss in case your trade does not reach your specified profit objective, and the market turns against your trade. Similarly, for a short position that has become very profitable, you may move your stop-buy order from loss to the profit zone in order to protect your gain.

A limit order is placed when you are only willing to enter a new position or to exit a current position at a specific price or better. The order will only be filled if the market trades at that price or better. A limit-buy order is an instruction to buy the currency pair at the market price once the market reaches your specified price or lower; that price must be lower than the current market price. A limit-sell order is an instruction to sell the currency pair at the market price once the market reaches your specified price or higher; that price must be higher than the current market price.

- Stop vs Limit Orders: What are the Types of Orders in Trading? | IG EN.

- Types of Forex Orders?

- Navigation menu!

- How to Start Trading | Types of Orders | FX Trading | .

- practice options trading online.

- options stock zero sum.

- 100 free no deposit bonus forex?

- Market Order Types;

Limit orders are commonly used to enter a market when you fade breakouts. You fade a breakout when you don't expect the currency price to break successfully past a resistance or a support level. In other words, you expect that the currency price will bounce off the resistance to go lower or bounce off the support to go higher. To take advantage of this theory, you can place a limit-sell order a few pips below that resistance level so that your short order will be filled when the market moves up to that specified price or higher.

Besides using the limit order to go short near a resistance, you can also use this order to go long near a support level. In this case, you can place a limit-buy order a few pips above that support level so that your long order will be filled when the market moves down to that specified price or lower. Limit orders are used to set your profit objective. Before placing your trade, you should already have an idea of where you want to take profits should the trade go your way. A limit order allows you to exit the market at your pre-set profit objective.

If you long a currency pair, you will use the limit-sell order to place your profit objective. If you go short, the limit-buy order should be used to place your profit objective. Note that these orders will only accept prices in the profitable zone. Having a firm understanding of the different types of orders will enable you to use the right tools to achieve your intentions — how you want to enter the market trade or fade , and how you are going to exit the market profit and loss.

Order Types

While there may be other types of orders — market, stop and limit orders are the most common. Be comfortable using them because improper execution of orders can cost you money.

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.