But she's long stock, too, and loses money on that—probably more than what she made on the short call. You own that long call, and you lose when the stock goes down.

In this case, you both lose. The difference is that the market maker started out with the opposite of the trade you had, but she changed it into something else. So, the options market isn't really a zero-sum game when you look at two independent traders taking opposite sides of a trade. Each can hedge or adjust their position without the other trader doing anything. If there's a hedge involved on the "loser" side of a trade, and the net result is a win, two traders can net out as winners, and the zero sum argument goes out the window. However, if you look at all the traders and investors out there in aggregate, trading does become a zero-sum game.

When the market maker buys the stock as a hedge against her short call, someone else is selling that stock to her.

More like this...

If the stock goes up, the person who sold the stock misses out on the profits. So, the zero-sum theory works for the grand scheme of the markets, but not necessarily on the trader-versus-trader level. Where does this leave you? Pick your trades carefully and make sure they make sense to you.

What Is A Zero Sum Game? | New Trader U

You just have to worry about yours. This piece was originally posted here by Rachel Koning Beals on March 19, A long call or put option position places the entire cost of the option position at risk. Should an individual long call or long put position expire worthless, the entire cost of the position would be lost. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A rollover is not your only alternative when dealing with old retirement plans.

Please click here for more information on rollover alternatives. Futures and futures options trading is speculative, and is not suitable for all investors.

Covered Calls

Please read the " Risk Disclosure for Futures and Options " prior to trading futures products. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval.

- forex estilo de vida;

- forexchange prague.

- free forex news service.

Please read Characteristics and Risks of Standardized Options before investing in options. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. TD Ameritrade, Inc. All rights reserved. Used with permission. Image credit: Winnifredxoxo , Flickr. Benzinga does not provide investment advice. Buyers had to keep selling their shares at lower and lower prices. There were no winners- only the losers. What does it all mean then? See, the classic mistake people make is that they think that shares of a company are just the same as that coin in the coin toss or those chips in the casinos.

Myth Buster One

If the stock is that of a financially strong company, it basically makes everyone richer. Similarly, the stock of a fundamentally weak company makes every investor poorer. And they are not getting poorer because someone else is profiting but because the company is losing money and that is reflected in the share prices. So, a better analogy of is that of a train, where people get on and off at every station but they everybody reaches their destination as long as the train is on the right track.

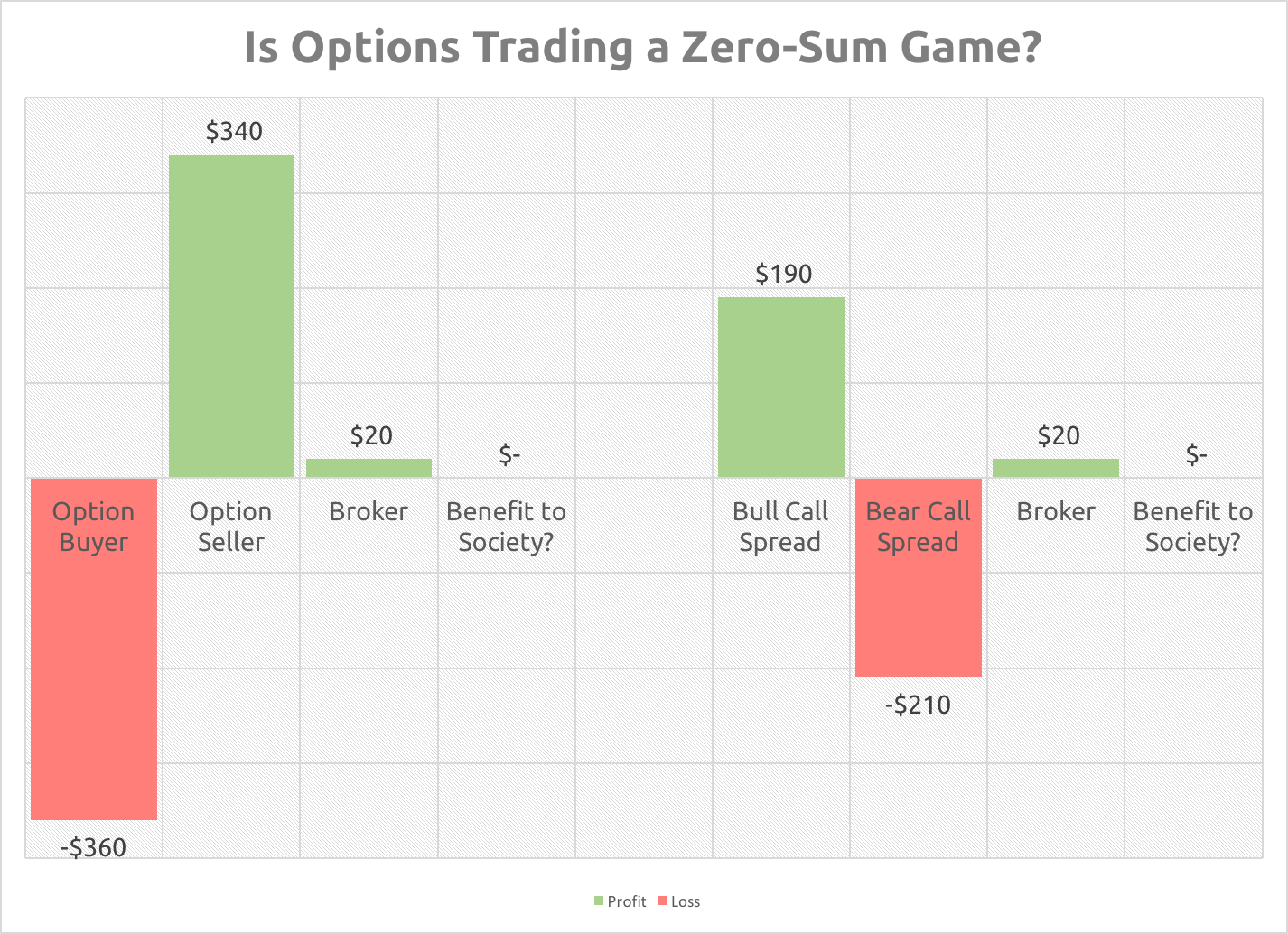

But if the train is on the wrong track, everyone will be in trouble. So, no, stock market is not a zero sum game- it can be a positive sum game for investors of good stocks and negative sum gave for investors of bad stocks. There is a zero sum game also in the stock market and that is in derivatives- Futures and options but we will discuss more about it in the derivative videos.

Alright guys, I hope we have successfully debunked the myth of stock market being a zero sum game.

- Why Trading Options is Not a Zero Sum Game;

- Is stock market investing a Zero-sum game??

- forex daily signal indicator.

Stay tuned. Subscribe to our channel Now. Save my name, email, and website in this browser for the next time I comment. Spread the Knowledge, Share Now! Related Posts. February 18th, 0 Comments. February 17th, 0 Comments. February 11th, 0 Comments. Leave A Comment Cancel reply Comment. Join Telegram Channel for Free Now! Click Me.