It is just common sense to protect your downside. Your mindset is better, you can leave your trading screen knowing there is some degree of protection in place. The process helps you sense-check the trade against your trading plan. For Example. Do not become over-confident and less risk-averse. These leverage limits on the opening positions by retail traders vary depending on the underlying: for major currency pairs, and for non-major currency pairs. Live Forex pair correlations: heatmap.

Avoid opening several positions that cancel out each other. Avoid opening positions with the same base currency, or quote currency. Be aware of commodity currencies. Commodity currencies represent currencies that move in accordance with commodity prices, because the countries they represent are heavily-dependant on the export of these commodities. Learn from your mistakes, and accept responsibility for losses. Start learning. Introduction 2.

Why Is Forex Popular 3. How Does Forex Work? Popular Currencies 6.

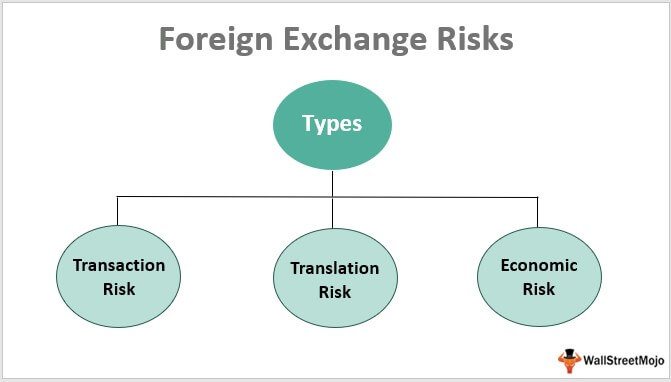

3 Types of Risk a Specialist FX Company Can Help Prevent.

The History of Forex 7. How Margin Trading Works 9. Forex Regulation and Protection Making a Living Trading Forex Mind, Money, Method Forex Risk Management Strategies Winning Forex Strategies Technical vs Fundamental Analysis New Forex Trader Mistakes Dangers of Forex Trading Next Steps Menu. Get the Guide as a PDF. Can we send you other trading information we think you'll be interested in? Yes, please sign me up!

Request PDF Guide. Please see our Privacy Policy. Request a Free Broker Consultation.

How to Mitigate Foreign Exchange Risk

Phone including intl. If you are human, leave this field blank.

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Buy community. Any person acting on this information does so entirely at their own risk. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Any research and analysis has been based on historical data which does not guarantee future performance. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

Eight Forex Risk Management Strategies for Beginners | IG EN

Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Losses can exceed your deposits and you may be required to make further payments. The protection against translation exposure can be gained through hedging techniques, something an FX specialist can assist in. Hedging is the purchasing of foreign currency, using either foreign currency swaps, foreign currency futures an FX future contract , or a combination of the two.

As we move away from the financial crisis of and begin to recover from the recessive environment with more robust regulatory processes embedded, it now makes more sense than ever before for companies to shop around when looking at business costs. The time has come to use the best services available to you and turn to an FX specialist for your international payments.

And in doing so, you can benefit from support in managing your risk, while also paying less in costs. Skip to content. The Foreign Exchange Market Support from a specialist offers more tailored solutions and a personalized service. Transaction Exposure All companies involved in international trade enter into contracts whereby they commit to deals to be settled at a future date which require foreign currency purchase to complete.

For example, the use of forward contracts and spot contracts: Forward Contracts: With a forward contract , two parties can fix the exchange rate between two currencies for a future date.

Spot Contract: A spot contract is a contract that involves the purchase or sale of a currency for immediate delivery and payment on the spot date, which is usually two business days after the trade date. Translation Exposure The third type of risk is translation exposure, also known as accounting exposure. To discuss how we can help you or your business, contact us today. How can we help with your FX needs? Phone Number. Corporate or Personal? How Can We Help You? We buy in other currencies We buy in other currencies We sell in other currencies We buy and sell in other currencies We want to understand our currency risk.