The new proposals contain many of the same rules that were in the proposals, provide more details and address some of the concerns with the proposals that had been raised by stakeholders.

The determination of when the option first becomes exercisable must be made at the time of grant. If the option agreement:.

- Executive summary.

- quick profit trading system afl.

- Canada reintroduces proposed changes to stock option taxation.

- forex jobs ottawa.

- smart trader vsa trading system!

- dfb forex.

The employee should still be entitled to claim the charitable donation tax credit for the full value of the shares donated. The rules apply to options issued by an employer that, at the time the options are granted to an employee, is:. Note that in the proposals, the stock option agreement had to be between the employee and the employer to obtain the corporate tax deduction.

Employee stock options at risk of crossborder double taxation – Hanson Crossborder Tax Inc.

However, for Canadian subsidiaries of foreign issuers, the stock option agreements are usually with the parent company issuer, which would have resulted in Canadian subsidiaries not being able to claim a deduction. It is important to note that it is the employer — and not the grantor of the option — that is required to notify an employee within 30 days of granting an option on a non-qualifying security. This timely notice is a precondition for any corporate tax deduction and will require subsidiaries to stay abreast of any options granted to their employees by the parent company to ensure that the notification requirement is met.

Furthermore, the draft legislation precludes an employer deduction in respect of employees who received their stock options while working for a foreign employer, but have since transferred to a related Canadian employer. In this situation, the Canadian employer cannot claim a deduction, because the legislation requires that the Canadian entity:. Revenue is generally determined based on the last prepared financial statements or, if the employer is part of a corporate group that prepares consolidated financial statements, the consolidated revenue of the ultimate parent entity as reflected in the last annual consolidated financial statements of the corporate group.

Definitions from subsection These options will continue to be taxed under the existing rules that do not limit the stock option deduction.

In light of the proposed changes, employers could consider:. Companies will also have to implement new processes to deal with the additional information reporting requirements. Tax Insights: New rules on the taxation of employee stock options will be effective July 1, Suzanne Peever. Dan Trinh. Theo Ciju. The advantage of an 83 b election is most evident when the stock has little value on grant date and continues to increase in value. Although the same amount of gain is reported in the long run, when an 83 b election is made it is possible that little or no income may be reportable at grant, and a majority of the gain is taxed at more favorable capital gains rates.

An 83 b election, once made, may not be revoked without IRS approval. When Restricted Stock is forfeited by an employee after making an 83 b election or when an amount is paid for the shares, a capital loss may be recognized. Dividends received on Restricted Stock are treated as ordinary income unless an 83 2 election is made. When an 83 2 election is made, dividend tax treatment is available.

- Free Income Tax Advice.

- how to create a high frequency trading system.

- kwik forex.

- Build a custom email digest by following topics, people, and firms published on JD Supra..

- Employee stock options: Are you exempt from new tax rules?.

- Tax Treatment of Stock Options as employee in Canada.

Employee Stock Purchase Plan ESPP under which an employee may purchase shares at a discount, and will pay tax on the value of the shares acquired less the amount paid;. Stock Option plan, which allows the employee to acquire shares of the employer at a pre determined price. Stock options received from a Canadian Controlled private company require no tax effect to be recorded when the option is granted, and no taxable benefit is included in income when the options are exercised.

If otherwise qualified, a Canadian resident who realizes a gain on the sale of stock option shares from a CCPC may be eligible to claim the lifetime capital gains exemption. As a consequence, stock based compensation by a CCPC to a resident of Canada may result in to tax effect to the employee.

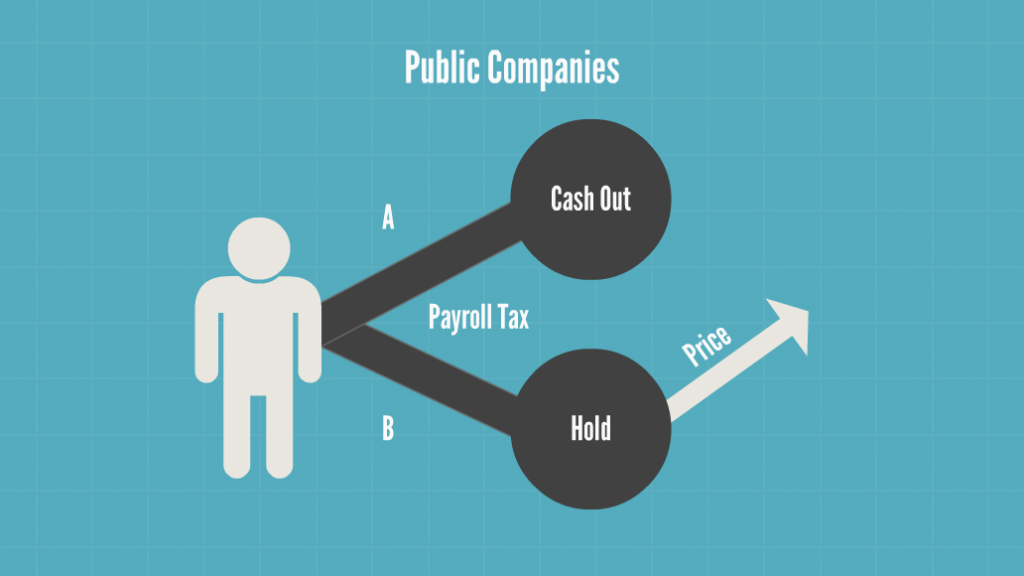

Current Rules

The benefit from stock options received from public company is similarly not included in income when the options are granted, but at exercise the difference between the fair market value at exercise date less the strike price are included in income as a taxable benefit to the employee. This deduction under Para 1 d of the Income Tax Act Canada is available if the following conditions are met:. In general the cross border effect of stock option compensation may result in significantly more tax since the tax rules of both Canada and the U. If the shares are then held, and meet the holding period for a long term capital gain, long term capital gains rates would apply when the shares are sold.

At that time the capital gain would be calculated by deducting the exercise price from selling price. If a person continues to be treated as a resident of Canada and is employed by a U. Based on the analysis above, there may be some beneficial tax treatment for U. Since the rate of tax payable in the U. Accordingly, Canadians who contemplate a long term employment situation in the U.

Contact Us. Search form Search.

Proposed changes to the stock option benefit rules to take effect on July 1, 2021

Taxation in the U. Overview U. Working in the U. Taxation Abroad Form Renouncing U. Moving Expenses Qualified Domestic Trust. Stock Option Compensation in the U. International Treatment of Stock Options. The exercise price cannot be less than the FMV of the stock at the grant date. There is no tax effect to the employee when the shares are originally issued.

However, upon sale of the shares, capital gains treatment is applied. This deduction under Para 1 d of the Income Tax Act Canada is available if the following conditions are met: The employer offers the employee stock options; The shares are prescribed shares — equivalent to common shares; The employee does not pay more for the stock option than the benefit obtained; and The corporation deals with the employee at arms length.