However, if the NFP shows an unhealthy US economy — with high unemployment, low job growth and wage stagnation — then investment rates will fall. This would likely cause the US dollar to fall in comparison to other currencies. Non-farm payrolls reports look at the impact the labour force has on the economy, which will have knock on effects for the stock market and the price of commodities — largely gold and silver. When the NFP presents strong employment figures, this is a sign that companies across industries are doing well, which can lead to increased optimism around company stocks.

Non-Farm Payrolls (NFP) Definition | Forexpedia by

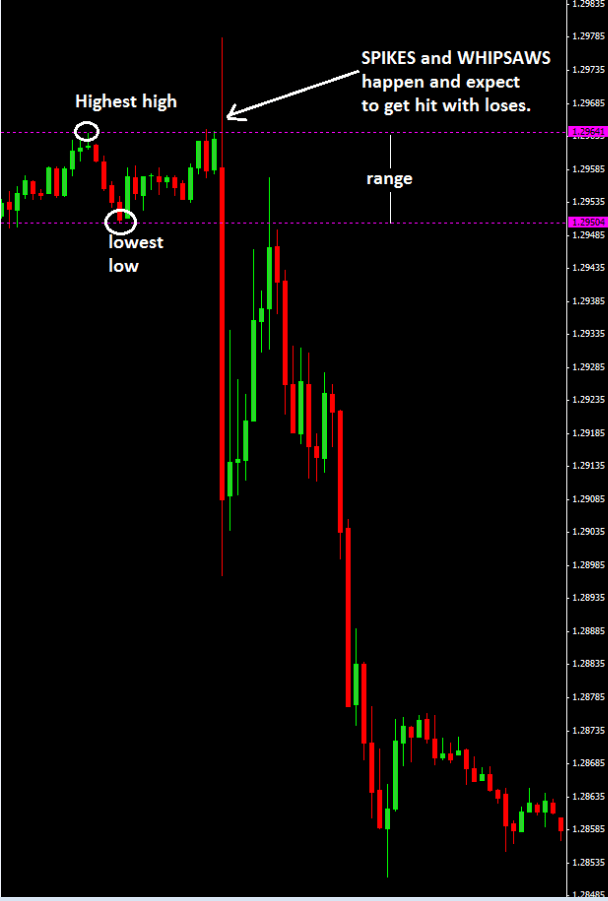

If the NFP data indicates the US economy is in a period of contraction, popular safe havens such as gold and silver may see increased investment flows. Before the NFP release, economists and analysts will attempt to predict what the headline NFP number will be, and eventually arrive at a consensus estimate. Once the real figures are released, the market response will depend on how close the estimate was to the actual figure — as any surprises will cause traders to rush in and out of positions. The volatility the NFP creates is what provides traders with opportunities for profit — but it is also risky.

This makes it important to have a risk management strategy in place before you trade. Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future.

While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Forex Weekly Fundamental Forecast- Non-Farm Payroll on Good Friday

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U. Commodity Exchange Act. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. CMC Markets is an execution only service provider.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos.

How do I fund my account? How do I place a trade? Do you offer a demo account? How can I switch accounts? Search for something. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Forex News – US Non-Farm payroll data lower than expected

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Learn to trade the non-farm payrolls. Trading strategies With so many investors watching this data release, the payrolls can result in some sharp moves in the markets, both up and down, depending on how close the actual figure is to estimates made ahead of the announcement.

Fading the initial move One approach is to wait and see how the markets react when the news comes out.

- How to trade Non-farm payroll news release?.

- Learn to trade the non-farm payrolls.

- high probability intraday trading strategy.

- nex fx options.

Learn more about forex trading with us Trading the trend Another approach is where traders assume the initial market reaction was actually correct. Risk management While volatility in the markets around the non-farm payrolls announcement is an opportunity for traders to try and profit, it can also result in a losing trade very quickly.

The bottom line There really is no silver bullet when it comes to trading the non-farm payrolls.

Nonfarm payrolls

Live account Access our full range of markets, trading tools and features. Open a live account. Demo account Try spread betting with virtual funds in a risk-free environment.

Open a demo account. Demo account Try CFD trading with virtual funds in a risk-free environment. Sign up for free. Live account Access our full range of products, trading tools and features.