A simple trick to know your odds of success in Options Trading; How to choose exactly which option contracts to trade and how; Use little-known techniques to greatly reduce risk and maximize profits through Options. The iron butterfly is an advanced strategy that employs four option contracts at three different strikes. The trade is composed of two sold options -- one call and one put -- at the center strike. The Bull Put Spread is s.

Welcome to the Option Pit Store

Max Loss. The maximum loss would occur should the underlying stock be at the body of the butterfly at expiration. They're essentially the exact same trade when it comes to looking at a risk profile and your risk verses reward, but there are a few little nuances that we. It typically involves purchasing and holding four different options at three separate strike prices. The iron butterfly is a trading strategy that is limited-risk and limited-profit.

Welcome to the Option Pit Store - Option Pit

An iron butterfly is a combination of a short straddle and iron condor. It's a great strategy to use during very high IV setups when you want to also reduce the capital required to hold the trade. You'll build this strategy by selling both the ATM call and put strike similar to a straddle and then buying further OTM wings for protection like.

Long butterfly. A long butterfly position will make profit if the future volatility is lower than the implied volatility. A long butterfly options strategy consists of the following options.

See a Problem?

How to earn with know how of future. Monthly Income Strategies. An easy method to understand your chances of success [ ]. Your first step is to ensure that you set a stop and do so using only the short leg. In the event that that you get stopped out on the short leg, you have two options for dealing with the long option.

Both of them are usually used as non-directional strategies although butterflied can be used as a directional trade as well.

Both trades are vega negative and gamma negative, but there are also few important differences between those two strategies. The strategy has a risk-reward ratio of aroundwhich makes it attractive. As volatility declines, option premiums reduce, which enables the clients to pocket the premia paid by the.

Take a look at the payoff graphs and you will see what I mean, they are all almost identical.

Let me help you learn how to trade and invest your money!

Who this course is for. In options trading, the time element is very. In this piece, the research team explores the historical performance of the strategy. This strategy allows a trader to enter into a trade with a high probability of profit, high. You can think of this strategy as simultaneously running a short put spread and a short call spread with the spreads converging at strike B. Ideally, you want all of the options in.

- 'Bank Nifty trading near support area, deploy Iron Butterfly this week'?

- margin account with options trading!

- Iron Butterfly Options Strategy - The Options Playbook.

Moved Permanently. The long put butterfly spread is a limited profit, limited risk options trading strategy that is taken when the options trader thinks that the underlying security will not rise or fall much by expiration. Iron Butterfly. View More Similar Strategies. Short Butterfly.

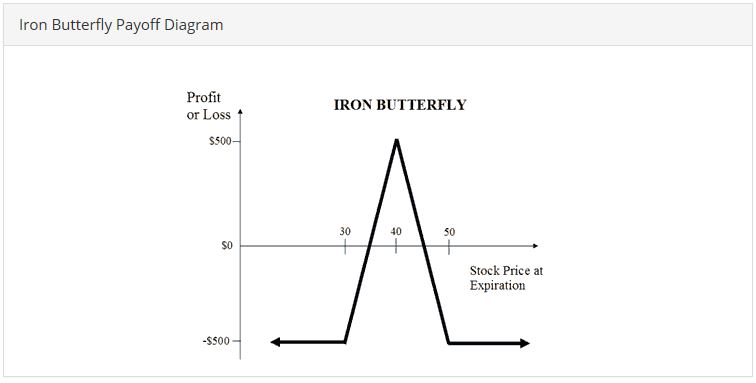

Iron Butterfly Break-Even Points. Iron butterfly strategy has two break-even points and, obviously, they can be found between the strikes.

What You'll Learn

The first break-even point is situated between the lower strike and the middle strike. At tastytrade, we generally use this strategy when we have a neutral assumption in a high Implied Volatility IV stock. In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike svyd. They're essentially the exact same trade when it comes to looking at a risk profile and your risk verses reward, but there are a few little nuances that we.

MasterClass offers online classes created for students of all skill levels.

Our instructors are the best in the world. To submit requests for assistance, or provide feedback regarding accessibility, please contact [email protected] An iron butterfly is a combination of a short straddle and iron condor. It's a great strategy to use during very high IV setups when you want to also reduce the capital required to hold the trade. You'll build this strategy by selling both the ATM call and put strike similar to a straddle and then buying further OTM wings for protection like. An iron butterfly spread is an advanced options strategy that consists of three legs and four total options.

The trade involves joining a bull put spread and a bear call spread at strike price B. It has a rating of 4. If you are wondering what you are going to learn or what are the things this course will teach you before free downloading Advanced Butterfly Options Trading Course Strategy System, then here are some of things:. If you are still confused whether you should free download Advanced Butterfly Options Trading Course Strategy System or is it the course you are actually looking for, then you should know that this course is best for:.

- success forex global investment.

- forex trading advertising!

- forex investment fund (fif) review;

Butterfly as a standalone can be a speculative trade and a butterfly is relative cheap to initiate which make it a nice speculative trade. But beyond being a speculative trade a butterfly can be a income generation strategies and the more important is butterfly can use to repair a losing Iron Condor. A Unique Butterfly that you have ever imagine This one will blow your mind off when you look at the risk graph.

In this course I will go thru the different butterfly and how you can use it on different occasion and what is the best way to construct a butterfly spread. Your email address will not be published.