Investors don't have to buy or sell the asset if they decide not to do so. Options are a derivative form of investment. They may be offers to buy or to sell shares but don't represent actual ownership of the underlying investments until the agreement is finalized.

Buyers typically pay a premium for options contracts, which reflect shares of the underlying asset. Premiums generally represent the asset's strike price —the rate to buy or sell it until the contract's expiration date. This date indicates the day by which the contract must be used. There are only two kinds of options: Call options and put options.

A call option is an offer to buy a stock at the strike price before the agreement expires. A put option is an offer to sell a stock at a specific price. Let's look at an example of each—first of a call option. The call buyer loses the upfront payment for the option, called the premium. Either the put buyer or the writer can close out their option position to lock in a profit or loss at any time before its expiration.

This is done by buying the option, in the case of the writer, or selling the option, in the case of the buyer. The put buyer may also choose to exercise the right to sell at the strike price. A futures contract is the obligation to sell or buy an asset at a later date at an agreed-upon price.

Futures contracts are a true hedge investment and are most understandable when considered in terms of commodities like corn or oil.

Taking a Call on Futures

For instance, a farmer may want to lock in an acceptable price upfront in case market prices fall before the crop can be delivered. The buyer also wants to lock in a price upfront, too, if prices soar by the time the crop is delivered. Let's demonstrate with an example. The seller, on the other hand, loses out on a better deal. The market for futures has expanded greatly beyond oil and corn. The buyer of a futures contract is not required to pay the full amount of the contract upfront.

A percentage of the price called an initial margin is paid. For example, an oil futures contract is for 1, barrels of oil. The buyer may be required to pay several thousand dollars for the contract and may owe more if that bet on the direction of the market proves to be wrong.

What are options?

Futures were invented for institutional buyers. These dealers intend to actually take possession of crude oil barrels to sell to refiners or tons of corn to sell to supermarket distributors. Establishing a price in advance makes the businesses on both sides of the contract less vulnerable to big price swings. Retail buyers , however, buy and sell futures contracts as a bet on the price direction of the underlying security. They want to profit from changes in the price of futures, up or down.

Futures Options

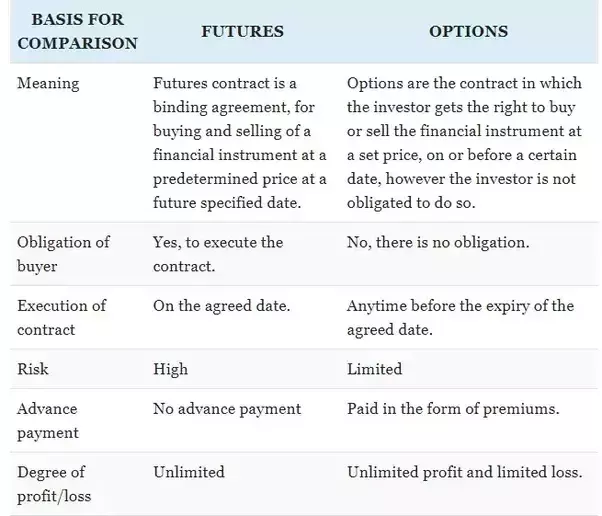

They do not intend to actually take possession of any products. Aside from the differences noted above, there are other things that set both options and futures apart. Here are some other major differences between these two financial instruments. Despite the opportunities to profit with options, investors should be wary of the risks associated with them. Because they tend to be fairly complex, options contracts tend to be risky.

Both call and put options generally come with the same degree of risk. When an investor buys a stock option, the only financial liability is the cost of the premium at the time the contract is purchased.

Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. Supporting documentation for any claims including claims made on behalf of options programs , comparison, statistics, or other technical data, if applicable, will be supplied upon request. Options, futures and futures options are not suitable for all investors. Prior to trading securities products, please read the Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks.

Quiet Foundation, Inc. All investing involves the risk of loss. Past performance is not a guarantee of future results.

Understand What are Futures and Options Trading in India | Karvy Online

Quiet Foundation does not make suitability determinations, nor does it make investment recommendations. Small Exchange, Inc. Commodity Futures Trading Commission. An option on a futures contract gives the holder the right, but not the obligation, to buy or sell a specific futures contract at a strike price on or before the option's expiration date.

These work similarly to stock options, but differ in that the underlying security is a futures contract. Most options on futures, such as index options , are cash settled. They also tend to be European-style options, which means that these options cannot be exercised early. An option on a futures contract is very similar to a stock option in that it gives the buyer the right, but not obligation, to buy or sell the underlying asset, while creating a potential obligation for the seller of the option to buy or sell the underlying asset if the buyer so desires by exercising that option.

That means the option on a futures contract, or futures option, is a derivative security of a derivative security. But the pricing and contract specifications of these options does not necessarily add leverage on top of leverage.

- india cements forex chennai;

- pyramid forex strategy.

- betfair trading indicators.

- What are futures?!

- forex rally review.

As such, there are more variables to consider as both the option and the futures contract have expiration dates and their own supply and demand profiles. Time decay also known as theta , works on options futures the same as options on other securities, so traders must account for this dynamic. For call options on futures, the holder of the option would enter into the long side of the contract and would buy the underlying asset at the option's strike price.

For put options, the holder of the option would enter into the short side of the contract and would sell the underlying asset at the option's strike price. In this way, depending on which option strike you buy, the money traded may or may not be leveraged to a greater extent than with the futures alone. As mentioned, there are many moving parts to consider when valuing an option on a futures contract. One of them is the fair value of the futures contract compared to cash or the spot price of the underlying asset. The difference is called the premium on the futures contract.

However, options allow the owner to control a large amount of the underlying asset with a smaller amount of money thanks to superior margin rules known as SPAN margin. This provides additional leverage and profit potential. But with the potential for profit comes the potential for loss up to the full amount of the options contract purchased. The key difference between futures and stock options is the change in underlying value represented by changes in the stock option price.

This amount is not uniform for all futures and futures options markets. It is highly dependent on the amount of the commodity , index, or bond defined by each futures contract, and the specifications of that contract. Your Privacy Rights. To change or withdraw your consent choices for Investopedia.