On the above chart, when the price closes a candle below our support area, we identify this as a bearish breakout. After that, the price resumes its downtrend. Notice that the price has formed a Descending Triangle. Descending Triangles are technical chart patterns that show price contraction, and this formation, like other contracting patterns, will eventually lead to a breakout and create a new price movement.

The direction of the breakout is typically unknown. This means that the breakout from the pattern could send the price in either direction. For this reason, we should carefully watch both the support and resistance levels for potential clues. Whenever we identify the likely breakout direction, we should react with a position in that respective direction. Notice in this example, that I have framed with rectangles the upper and the lower levels of the triangle.

Day Trading With HMA-Bollinger Bands | Trade With Greed And Ease, Be A Nifty Day Trader

This way I know the exact areas which the support and the resistance of the triangle are likely to cover. Notice that on the lower side of the triangle there is a candle wick which goes deep into the support area. If we had just a single line indicating our support, the wick might have lured us into thinking there was a bearish breakout. In the red circle you see the exact location of the eventual breakout, which was to the upside. Notice the strong momentum on the breakout illustrated by multiple green marubozu candles. After the price breaks through the upper level of the triangle, it then retraces back in order to test the already broken resistance which is now considered a support area.

This type of breakout pullback scenario is a very important confirmation signal in breakout trading, which we will discuss later in the article as well. For me it is a general rule that a candle wick beyond a psychological area is not a breakout. I consider a real breakout to occur only in situations when the price of the pair closes the candle beyond the level.

This way we get a more reliable breakout signal, one which can be used to trigger a position in the respective direction. Have a look at the image below:. Again, we have a descending triangle with an upper resistance area and a lower support area. I have marked these with the blue rectangles. Notice the way the rectangles contain the bottoms of the price. The lower rectangle is located according to the first and the second bottom of the triangle.

The upper rectangle contains all the tops of the price, except one candle which is pin bar style rejection candle. This is our first fake breakout.

Tier-1 Interbank Liquidity & Raw Spreads

We have only a candlewick going above the resistance area. However the candle does not close with its full body above the resistance area. For this reason we disregard this breakout signal and we would classify it as a false breakout. We get a second fake breakout afterwards. The last bottom of the price goes below the support area with its candle wick. The candle is also a Pin Bar formation , also called a hammer pattern, and bounces strongly off the support zone.

Again, since we have no candle closing below the support area, we would disregard this as a breakout signal. The Pin Bar subsequently pushes prices higher and five periods later we have a candle closing above the resistance area. This is our valid breakout signal. Notice that the breakout candle is a strong Marabozu candle, which further confirms that this would be a reliable breakout signal.

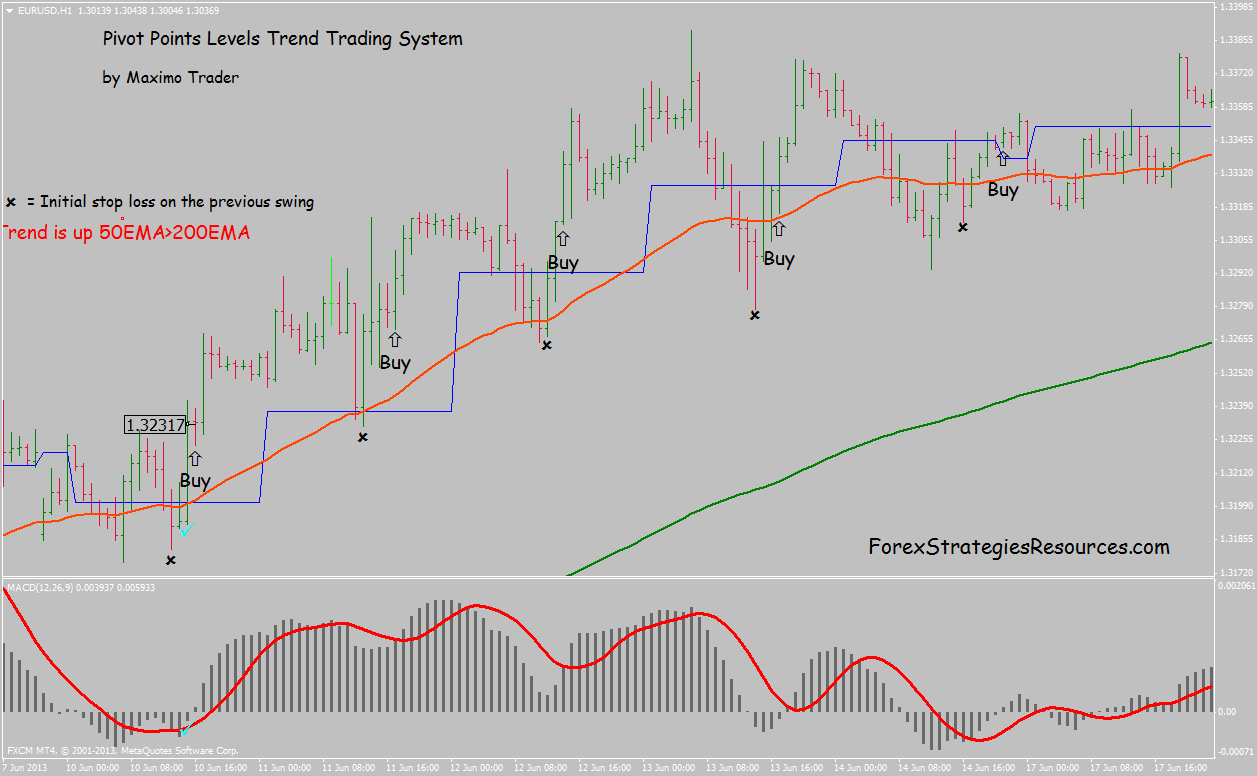

Pivot points

Actually, it is not enough only to see the price breaking through a certain level in order to take a position in the respective direction. Though you can certainly initiate a trade after the initial candle close beyond the breakout point, there are better entry techniques in my opinion. They do require more patience on the part of the trader, and do not always materialize.

But keep in mind, we are looking to trade the highest probability breakout trades, and not just every setup that comes around. Therefore, I have prepared 4 steps for you, which will confirm a breakout and we will set certain rules for triggering a breakout trading position. The following example illustrates a bullish breakout:. Stage 1 : A breakout appears as in the examples above. We observe price increasing and eventually goes through a psychological resistance.

The price closes a candle above the resistance and we identify the breakout. Stage 2: The price creates a top after the breakout.

In this example, the increase continues for two more periods, and then starts to move downward. This creates the top we need.

- forex visual studio.

- margin account with options trading.

- forex news release calendar.

- 10# Pivot Intraday Trading System?

- xenon forex.

- Pivot points leveles Trading Systems?

Typically the top we are looking for will be a fractal formation, meaning that the highest high will have two bars to the left of it with lower highs and 2 bars to the right of with lower highs. The reverse would apply for a bottom. Stage 3: The price retraces back to the already broken resistance and tests it as a support.

The decrease continues and the price tests the already broken resistance as a support.

When the price touches the broken resistance, it bounces upwards, implying that this is now a strong support area. Stage 4: The top after the breakout gets broken. After we see a candle closing above the top, which was settled after the breakout, we have a strong confirmation that the price might really continue in this direction. Such situations are extremely useful to trade.

You could apply this 4 step breakout signal confirmation in order to trade range consolidations. These are situations, where you have a breakout in a chart pattern for example and you expect the price to move equal to the the size of the formation. If you are not confident in reading pure price action as it relates to breakouts, then you could consider using an additional trading indicator to help. One powerful indicator that a trader could utilize for a breakout trading system is the Momentum Indicator. The Momentum Indicator consists of an area and a curved line which fluctuates in the area of the indicator.

When the Momentum is moving upwards, it gives us a signal that the price is likely to follow this trend. If the Momentum is moving downwards, this hints that the price is likely to decrease too. Also, extremely high readings in the Momentum Indicator suggest that the uptrend is likely to continue. At the same time, extremely low readings in the Momentum Indicator are inferring that the current bearish trend is likely to expand.

- STANDARD PIVOTS Metatrader Indicator For Mt4.

- Set and Forget Pivot Point Trading System!

- Pivot Points Indicator Explained;

- online options trading brokers;

- How to Set-Up the Telegram Service.

- The Advantages and Disadvantages of Set and Forget Trading.

I believe the optimal way to use the Momentum Indicator is for spotting divergences. We have a bullish divergence when the price is moving downwards and the Momentum Indicator is increasing. At the same time, we have a bearish divergence when the price is increasing and the Momentum Indicator is decreasing. The divergence is a good indication that the price is likely to reverse soon. Have a look at how the Momentum Indicator works with a breakout trading strategy:. If you want a speedy reply to your questions just post your questions on our Telegram chat group.

Risk Disclosure : Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds.

This may work against you as well as for you. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. If you fail to meet any margin requirement, your position may be liquidated and you will be responsible for any resulting losses. Search store for products Close. My account My account Close. New Registration Log in.

Shopping cart Close.

Pull back indicator mt4

You have no items in your shopping cart. Trading Software. Menu Close. Back Trading Software. Add to compare list.