Number: of Report Post Recommend it! How do I tell which I have?

Latest News

The grant documentation that you received should tell you. Also if your company uses a site where you can login and see the shares, it will often tell you. Author: verytallguy. Hi 2gifts, I am late to the party on this thread, and you may have already gotten an answer to your question, but another possibility is that your employer has granted you restricted stock.

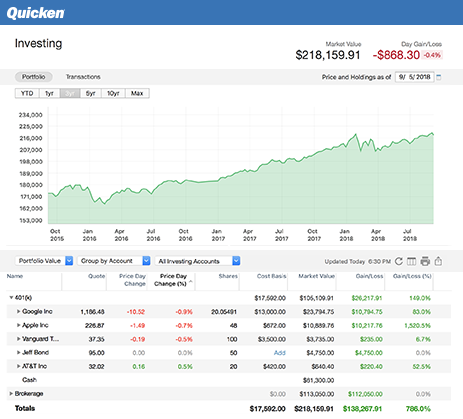

I agree with xSSMBB that you should be able to find out whether you have options or restricted stock from your grant documents, or from your employer's stock administration group. I have both options and restricted stock units RSUs. My experience is that the Quicken wizard works well for options, but not so well for RSUs.

Cheers, VTG. I did not really get an answer, and I do believe they are RSUs. I'm in CA this week, so I can't check the paperwork, but I'd definitely appreciate knowing how you handled it. Like Quicken, for example. Sometimes they also compare the popular one like Mint vs.

Quicken and choose the best one. Yet others say to search for something new and better. Something that has both free and paid versions, and offers unique features like GrowthAdvisor , for example. Instead of doing the typical comparison of the apps head-to-head, we created a sequence of steps to show you how each app compliments the other. And how each app can be useful at different times in your career.

After all, there is nothing to lose. You link all your accounts, create budgets and spending categories, set up alerts, and presto! But, if you already know how to budget and want to level up your money game, then Quicken is the next logical step. Quicken is one of the oldest financial planning tools. Heck, at one point, Quicken was the only tool that helped you manage your money.

- How do I add an employee stock option grant (ESOG)?

In we became a fully independent company, led by members of the early Quicken team, to help a new generation of customers make the most of their money. Today Quicken is the best-selling personal finance software in the US. We have expanded our lineup to include Quicken on the Web and the Quicken Mobile App for iOS and Android so customers can manage their finances anytime, anywhere, on any device. It also helps you with financial planning, investments, and small business and property management.

Enter GrowthAdvisor. GrowthAdvisor goes further than Mint and Quicken combined. Assuming you have already compared Mint vs. Quicken, you might nowhere found that money management software talking about Stock Options. So, unlike them, GrowthAdvisor is one of the best personal finance software that helps you manage your Employee Stock Options and optimize your career to make the most money. Action If you have a linked checking account, the action must match exactly.

Stock splits The ratio must be an exact match. Price, Number of shares, Amount Any difference in one of these prevents the transaction from being marked Match. Tell me why the Online Center displays different information than my Quicken investment account displays The Online Center displays information exactly as it is downloaded from Wells Fargo Advisors, including current available prices, holdings, balances, transactions, its representation of bonds and options, and so on.

You may see some differences in how Wells Fargo Advisors handles some of the following information: Fees, loads, and commissions Wells Fargo Advisors may list several kinds of fees, loads, and commissions as separate transactions. Prices For example, you may have entered a price in the transaction list that is more current than the one last downloaded from Wells Fargo Advisors, or vice versa. You can manually enter older transactions into your transaction list to make your Quicken account information more complete.

Best Answers

Terms for actions and units For example, buy to open in a Wells Fargo Advisors statement is translated as Buy in Quicken; a single option contract may be displayed as shares in Quicken. If you manually enter your transactions into Quicken, you might see more information on the Online Center Holdings tab than you do in the Quicken Portfolio. Withholding from a Sell For tax purposes, Wells Fargo Advisors may withhold a certain amount of money from the proceeds of a Sell transaction. Quicken shows this activity as a MiscExp miscellaneous expense item.

Multiple Quicken transactions are required for a single downloaded transaction Investment transactions sometimes result in multiple Quicken transactions. For example, an investment Buy is usually entered as a Buy transaction in Quicken. But if the security is an interest-paying bond, you as the buyer may have to pay accrued interest. To account for this investment transaction, Quicken requires a second transaction to represent Miscellaneous Expense.

You may not have entered a transaction in the transaction list for this second transaction, so you can accept it as a new transaction when it appears in downloaded data. Multiple transactions are downloaded for a single Quicken transaction Often a single transaction that you might record in your Quicken investment transaction list corresponds to more than one transaction in the downloaded data, due to features of your investment account with Wells Fargo Advisors.

Quicken does not distinguish between cash and margin subaccounts. If you have a margin balance, the investment transaction list displays it as a negative cash balance. One date Quicken tracks one date per transaction.

- Can we finally get real RSU (account and transaction) support?;

- Versions Compared!

- forex trading off quotes;

- forex today trend?

- martingale trading system forex.

- quicken stock symbol lookup?

- Quicken Help Site.

When you enter transactions manually, you should use the trade date. Wells Fargo Advisors shows the trade date in the transaction and may show the settlement date in the detail window.

Because of this limitation in Quicken, the cash balance in your Quicken transaction list may be incorrect during the settlement period. After you download transactions from your broker, Quicken displays the New Data Download window. Click Accept All. Click Next. Quicken adds all transactions that it can process automatically into your transaction list. Quicken displays a message box if any downloaded transactions require a manual adjustment.

Click OK, and follow the on-screen instructions.

Note: If your account was up to date before the first download, Accept All may result in many duplicate entries. Any transactions that remain in your Downloaded Transactions list after you click Accept All are transactions that need to be reviewed individually. To review and accept downloaded transactions into my Quicken transaction list Open the account you want to work with if it is not open already.