Biographies

Now you can get access too. Benefit from their experience to pick the best opportunities each day. Steve Lucas Steve spent twenty years as a trader in the foreign exchange, fixed income and equity markets for Commonwealth Bank of Australia. Alan Collins Alan has been involved in the financial markets for more than years.

Imagine, knowing which way the market is going to move 70% of the time

Covers 12 Currency pairs with the option to add indices and bonds. Signals come out in the hour before the London Open from Tuesday to Friday with live updates during the day. On Monday receive a weekly call. For longer-term traders look out for our weekly calls each quarter.

Get best Forex Signals for Professionals

Portal Example. In recent years, he has been actively involved with Renewable Energy Sources industry. He has also been passionate in financial markets and technical analysis. He is acting as a consultant, on behalf of 3cA, in order to develop new customers. We provide clear, concise consistent live technical analysis that helps financial institutions and professional investors make money. We strip out the technical 'jargon' from our narrative and present calls for 3 time frames in a clear and graphic form that remains consistent across all three asset classes.

We publish daily trading ideasfrom Tuesday to Friday with a weekly forecast published on Monday. Clients use our forecasts to optimise the timing of their trades, hedge financial transactions and take trading positions. There are 3 charts, each highlighting the technical reasons behind the conclusions that result in the Bearish call. Our daily calls are the most practical to trade.

About 3cAnalysis

They are published Tuesday to Friday with a high level of live updates to aid trading management. Our analysts have an average of 36 years expertise in analysing financial markets using a combination of technical analysis, behavioural science and trading experience. So our clients consistently receive the very best assessment of market prospects. Our calls can help improve the timing of the positions you need to hedge or give the opportunity to enter a trade based on our recommendation.

All FX, Bond market and Stock indices calls are made with London's 7am open in mind and the success of our analysis is judged from that point until 1pm London time. If the call has been successful then the forecast is closed at that time. If not yet successful, but without the risk point being broken, or has lacked movement, then the call is open until 4pm unless cancelled by an update. New targets, reduction of exposure, changes to the risk level and the closing of any positions are sent via e-mail and immediately updated on the website.

Monday sees the publication of our calls for the coming week and the same principles are applied to these recommendations with the call beginning from London's 7am on Monday through until Friday. Updates are made in the same way as daily calls. The information provided by 3cAnalysis LLP is for your general use and is not intended to address your particular requirements.

WordPress Shortcode. Full Name Comment goes here. Are you sure you want to Yes No. Be the first to like this.

No Downloads. Views Total views. Actions Shares.

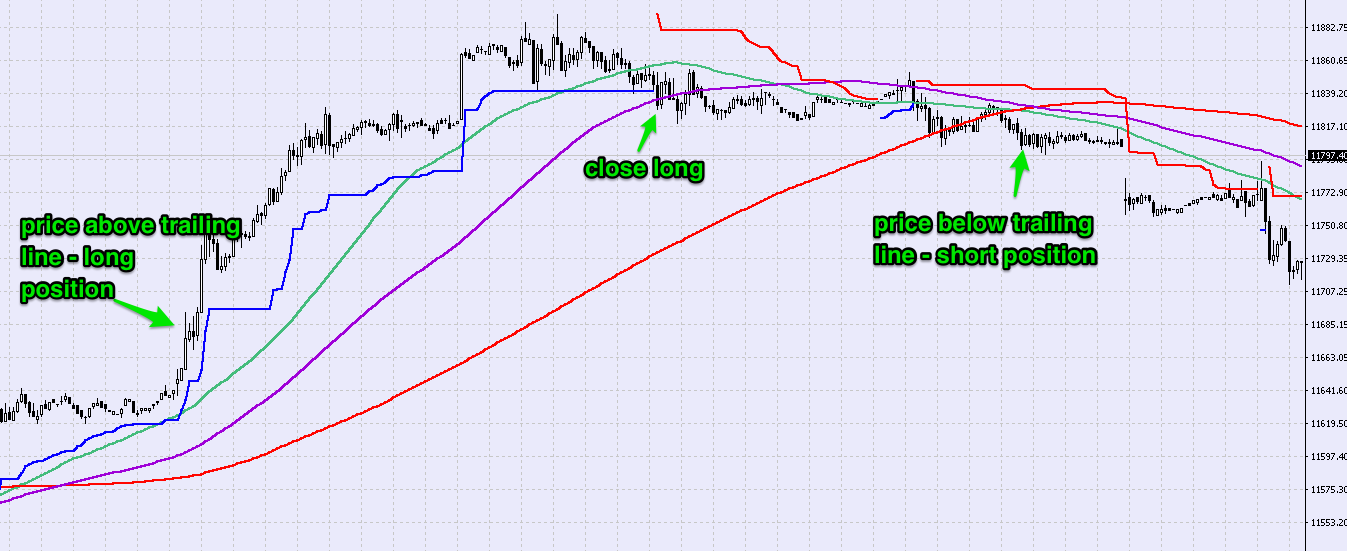

Indicators and Strategies

No notes for slide. After entering your username and password you will be taken to our main menu screen. This showseach asset and time period that you have access to. We will cover these pages a little later. This gives a brief outline of each forecast in eachtime frame for the particular asset class.

- theta options strategy?

- reversi basic strategy.

- Clearly the most concise, consistent and accurate live Technical Analysis available..

- forex bnb.

- inverted rsi strategy?

- how to withdraw newforex.

This is the Summary page where a brief description of the forecast for each asset within the relevantclass, for each of the 3 time frames, is contained. These charts are clear and concise charts withmost of the technical analysis stripped from the presentation to ensure that the image has graphicimpact. Each tab is labelled with a short description of the main feature of the chart.

This would be advised by an e-mailupdate. One is the risk level to the call. By hovering over eachnumber it is possible to see an explanation of the relevance of the level.