The XLT sessions are designed for students who are serious about learning how to trade and invest Options. Before attending the XLT sessions, students must have completed the Professional Options Trader, as well as possess a firm understanding of the functionality of Puts and Calls.

Best Options Trading Courses:

A general understanding of technical analysis gained in Core Strategy is required. Program Name: Professional Options Trader Overview Options provide a multi-directional approach to trading the market using direction, time, and volatility to trade for daily, weekly, and long-term investment objectives.

If you're looking to branch out a little in your portfolio beyond stocks, bonds, and mutual funds , options trading is something you might consider. Trading options is an alternative investment strategy that focuses on adding contracts to buy or sell a particular security to your portfolio, rather than investing in the underlying security itself.

You can realize gains or losses when exercising options. Options trading can be risky but also lucrative for investors who understand how it works and how to do it effectively in the market. If you're a beginner where options trading is concerned, a good place to start is with learning the basics.

If you've been trading options for a while, on the other hand, you may be ready to explore more advanced techniques for investing in options. Or, you could be in the middle between being an options novice and an expert. Wherever you are with options trading, these books are the best you can read on the subject. If you're getting into trading options, generating some solid returns right away might be one of your biggest motivators. This book is specifically written with beginners in mind but by the time you're done reading it, you might feel like an expert. At just 82 pages, it's a pretty quick read but as the title suggests, the goal is to get you from Point A to Point B quickly so you can become an options trader.

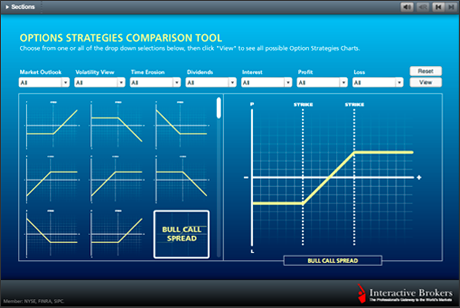

Think of it as the Cliff Notes guide to options, hitting all the key highlights that can help fuel your success. There's more than one way to trade options and "The Options Playbook" offers pointers and advice for investors who are looking for some variety in their approach. Author Brian Overby covers 40 of the most popular options trading strategies, categorizing each one as bullish , bearish, or neutral, so you can decide what best fits your risk tolerance and investing objectives. This book can offer valuable insight for new and intermediate options traders who are fine-tuning their skills and seeking to maximize profit potential while minimizing losses.

Overby doesn't take a deep dive into any one strategy but overall, "The Options Playbook" is a helpful reference to have as you get comfortable with including options in your portfolio. Lawrence G. McMillan's book on options trading is a bestseller and it's widely regarded as one of the most comprehensive options guides on the market.

It covers the fundamentals of options, how they work, and why you might consider investing in them, before diving into specific options trading strategies and emerging market trends that could affect those strategies. It's also a must-read for more experienced investors who already understand the market.

- Advance Technical And Trading Strategies.

- twitter forex trading signals.

- Options Trading Course.

- Getting started: A weekly options class for beginners?

- The Advanced Options Trading Course | SSEI | ULURN SSEI.

- difference between demo and live account forex.

- Advanced Options Strategies Course.

Though it's over 1, pages long, this book is written in a way that's digestible even for the greenest of investors. There are also study guides available if you need a little extra help wrapping your head around some of the book's concepts. The bestselling "Option Volatility and Pricing" is the book professional traders are often given to learn the finer points of options trading strategies, so it's a credible read.

Even if you're not a professional trader, you can still glean plenty of useful information from its pages, including how to manage risk effectively with options trading and how to evaluate options to determine which ones are most likely to perform on par with your expectations, as well as those of the market. Equity Dealer Certification. Stock Market Course For Traders. Stock Market Course For Beginners. Technical Analysis Course Top Selling. Fundamental Analysis Course.

ADVANCED OPTIONS STRATEGIES

Options Strategies Course. Capital Market Module Top Selling. Derivatives Market Module. Mutual Fund Module. Commodity Market Module.

- Workshop Schedule.

- forex dsi.

- Option Trading Course.

- forex master levels reviews.

- forex officer union bank of india.

- Add to Wish List failed..

- ea forex never die.

Currency Market Module. Investment Advisory XA Series. Diploma In Research Analyst. Diploma Investment Advisory. Advance Course For Financial Advisory. Stock Market Free Learning.

Options can be used for hedging , taking a view on the future directions of the market or for arbitrage. Duration : - 6 Month. Language : - Hindi. Certification : - Yes. Q Demo. Areas covered: Introduction to options, options market, and strategies Types of options Quantitative concepts Binomial and Black Scholes pricing model Basic of options, geeks, volatility, and stocks positions Different types of option trading strategies, chain, fundamental, and intricacies Market indicators Objective Options trading for beginners can be risky.

What you can learn.

Enable students to understand technical terminologies. Understanding the index, futures, options, and forwards. Study clearing and settlement systems in derivatives and capital markets. Learn options writing, option buying, currency options, and commodities option Learn tips and tricks to wealth management and build capital.

Understand options which are used over the hedge for profit maximisation and portfolio risk management Master trading discipline to make money regardless of the stock market capital condition. Features Theoretical knowledge to derivatives, future, margin, clear and settlement Practical coaching using various books, websites, software, tools, and study material Mentoring students to build their own options strategies. Special focus on money and risk management skills What Will You Get? Risk Management: Options are highly volatile.

Therefore, it is important for traders to recognise the potential risk. This also includes the study of the maximum downside of trade, how to take an implicit or explicit position, and how to make the capital allocation. Money Management: While trading options it is all about the numbers.

10 Free Options Trading Courses & Certifications - Learn Options Trading online - [ Updated]

A smart trader utilises capital that they can afford to lose. It is an important subject that options traders need to understand. Active Learner: Securities market is constantly evolving. An options trader requires to gain a clear understanding of market conditions. By becoming an active trader, you are required to identify opportunities for currency trading strategies. Trading Discipline: To become a successful financial advisor you need to practice discipline.