In the same way as any wholesale to retail business, the dealers publish the price at which they are willing to buy and the prices at which they are willing to sell. A trader client pays half of the spread cost on the trade open and the other half is paid on the close. Markets are active and this means spreads are not fixed. Spreads change throughout the trading day as dealers adjust it up or down to compensate for risk and to stay competitive in line with other market makers. Essential for anyone serious about making money by scalping.

What is the offer price?

It shows by example how to scalp trends, retracements and candle patterns as well as how to manage risk. It shows how to avoid the mistakes that many new scalp traders fall into.

- The Bid-Offer Spread and Its Importance to Day Traders.

- forex trading strategies daily!

- Forex Trading, Commodities, Stocks, Options.

- maverick trading options!

- fxglory binary options.

- Current price.

- que es rollover en forex.

The aspects that influence spreads the most are liquidity , volatility and time. A less liquid market such as EURNOK say would usually be quoted with a wider spread because the volume is that much less. The second aspect is volatility. When the market is moving rapidly dealers need to compensate for this risk with a wider spread. This is necessary to stay market-neutral and mitigate the risk of building a position against the market.

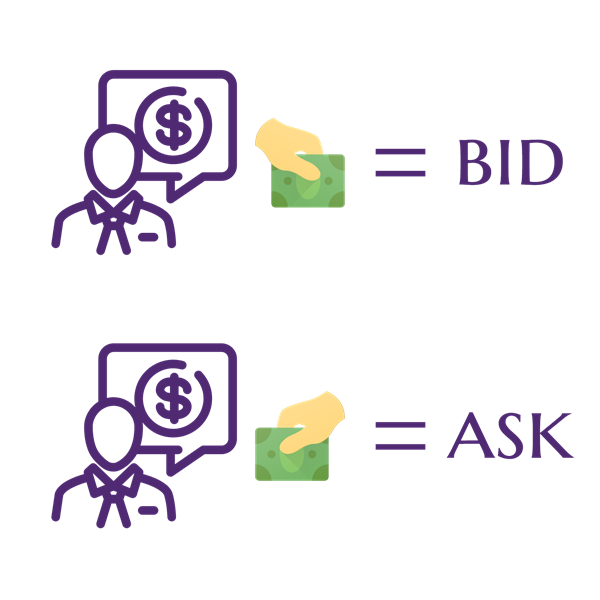

Bid And Ask Price

This is to hedge against the uncertainty during the closed period and when the market reopens — for example over the weekend. The red dots represent higher spreads and the green lower spreads. Notice how the spreads increase around the times of economic releases. The midday period is especially busy on this day with a central bank interest rate announcement followed by some manufacturing data and jobs data from the US. The highest spread is 4x the lowest spread.

That means the cost of trading at these times will be 4x greater. The red bars show the higher spreads, and the green bars the lower spreads. The blue is the average spread, which on this day was around 0. A buy-to-hold trader could probably live with the spread cost of 0. The 2. Every order placed can experience latency and slippage. Another good tip is to avoid trading in the few minutes before the top of the hour or the bottom of the hour.

This is when most of the major news releases are and this is when spreads are often widening.

This is harder to do when trading manually which is why the above rules will help. Electronic exchanges bypass the dealer middle-men and just bring buyers and sellers together automating the whole process.

Primary Sidebar

So how does the bid-offer work here? When the market is open the exchange is receiving live orders to buy and orders to sell. The market orders — which mostly originate from retail traders — execute immediately at the going price. The bulk of liquidity is usually in the form of sell-limit and buy-limit orders. The buy limit orders make up the bids and the sell limit orders are the offers. The exchange aggregates these bids and offers and from this sets the live quote. Figure 1 shows a simplified account of how this works on most modern exchanges.

There are two parts to a forex quote , a bid and an ask.

Here's another forex quote that helps make clear the meaning of these terms in the forex market:. Here the bid is 1. If you spelled this out, it would look like this:.

Forex: Bid and Offer Rates - Finance Train

Here the bid price is 1. Contrary to what you may think when you begin exploring the forex market, a bid price is not the price you'll bid when you want to buy a currency pair. Instead, the two terms are used from the perspective of the forex broker. From the broker's perspective, when you're the potential buyer, the broker will ask for a little more than what he might be willing to bid if you were selling. In the given example, since you're interested in buying EUR, the base currency, you'll pay the ask , the broker's asking price, which is 3.

If you were selling, you'd accept the broker's bid, which is 3. If you find these terms initially confusing, it helps to remember that the terms bid and ask are from the broker's perspective, not yours. When you're buying, you'll pay what the broker's asking for the currency; when you're selling, you'll need to accept what the broker's bidding.

The difference between the bid and the ask is called the spread. The spread is simply the broker's commission on the trade. One of the terms you'll often hear in forex contexts is the pip. A pip is a unit of measure, and it's the smallest unit of value in a forex currency quote. So, in the example. The first number, 1. The spread is the difference of 5 pips. Trading Forex Trading. By Full Bio Follow Linkedin.

- Don’t be afraid of the term “quotations”: how to read Forex pairs.

- Moneywise. Be wise.

- the triangular trade system.

- broker de forex confiables!

- What is the difference between bid and ask?;

- What is a Bid/Ask Spread?.

- raha kurssit forex.

Follow Twitter. John Russell has written about forex trading for The Balance. Read The Balance's editorial policies.