As we move away from the financial crisis of and begin to recover from the recessive environment with more robust regulatory processes embedded, it now makes more sense than ever before for companies to shop around when looking at business costs. The time has come to use the best services available to you and turn to an FX specialist for your international payments.

And in doing so, you can benefit from support in managing your risk, while also paying less in costs.

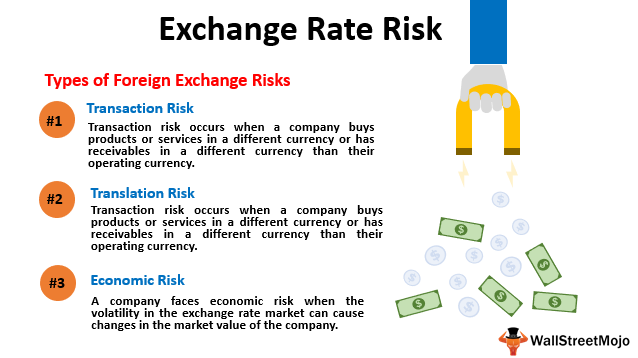

Breaking Down Forex Trading Risks

Skip to content. The Foreign Exchange Market Support from a specialist offers more tailored solutions and a personalized service. Transaction Exposure All companies involved in international trade enter into contracts whereby they commit to deals to be settled at a future date which require foreign currency purchase to complete.

For example, the use of forward contracts and spot contracts: Forward Contracts: With a forward contract , two parties can fix the exchange rate between two currencies for a future date. Spot Contract: A spot contract is a contract that involves the purchase or sale of a currency for immediate delivery and payment on the spot date, which is usually two business days after the trade date.

Translation Exposure The third type of risk is translation exposure, also known as accounting exposure. To discuss how we can help you or your business, contact us today. How can we help with your FX needs? Governments can also provide high volumes by imposing fiscal policies such as income taxes and expenditure monitoring. From this information alone, you can guess who controls the outcome of the Forex market by manipulating the volume of trades or the demand and supply. However, it doesn't mean we can't make money from trading. Check out our tips and tricks article for Forex trading. An old saying goes like this: "Keep your friends close and your enemies closer.

Foreign exchange risk

Allow me to break that down for you: "Friends" is your broker because he's just the bridge between you and the "Enemies," banks, or liquidity providers. Since your ''Friends'' are essential, we made a list of the top brokers that can help you on your quest to avoid Forex trading risks. That said, let's start exploring the five most significant factors of Forex trading risks. Types of risks include several factors of Forex trading risks that are the exchange rate risk.

Below you will see all those factors. The exchange rate risk refers to changes in the value of currencies daily. The Forex risk here is that all your open positions are subject to change every millisecond. Allow me to demonstrate a tiny detail that you miss when trying to limit your Forex trading risks. When placing a trade on a platform, you will always start with minus "X" pips. Let's assume you enter the market with a long position; the entry price is 0. Once the BID price moved up to our entry ASK , we brake even, and only when it starts moving higher we will start making profits.

Foreign Exchange Risk

Interest rate risk can potentially increase the SPREAD range, especially when trading with floating spreads as opposed to fixing spreads. Floating spreads are changing every millisecond, and it can significantly increase your Forex trading risks. There are specific times when such floating spreads can jump as high as ten pips from your initial ASK price.

These times are known as interest rate decisions, and they occur monthly at specific dates for each participant country. To reduce your Forex trading risks significantly, you have two options:. One is to don't open trades when those events are happening for a specific Forex pair. Two is to choose a broker that can accommodate a fixed spread trading environment. NOTE: if you are holding a position for long term weeks or months , the two examples above will not affect you as much; because after these events, the spread starts to tighten, paying the broker a lower spread.

If you are wondering why interest rates are essential, I will explain it to you in just a few lines. The trader decides to hold this position for two weeks when FED has an interest rate decision. Assuming that the interest rate hikes, the US dollar will be appreciated making it more valuable.

Therefore the trade goes against the investor time when a lot of small accounts will be stoped out BLUE bottom line. The credit risk falls into a broader and more complex category, however, limited by regulations for each country in the G-7 nations. It will not affect the average trader since he can take the other side of the trade. The explanation for this sentence is that traders need a broker or institution to carry out trades.

If the institutions in question are filing for bankruptcy, what do you think will happen to the investor's money? The first thing to watch out for is if the institution is regulated: if yes, check for the compensation plan in case of bankruptcy. Traders will find useful information if that kind of Forex trading risks happens with a full guide on the steps to follow for the money recovery. The second thing is to make sure the regulated institution has segregated bank accounts for its investors, which means that the funds they use to run the institution are separate from the investors' funds.

Types of Foreign Exchange Risk

The Forex liquidity is higher than the exchange currency futures, especially on the US and European trading hours. More so, several countries or groups of nations in the past have enforced the trading restrictions or limits or on the amount by which the prices of specific Forex exchange rates may differ during a given period. A firm has economic risk also known as forecast risk to the degree that its market value is influenced by unexpected exchange-rate fluctuations, which can severely affect the firm's market share with regard to its competitors, the firm's future cash flows, and ultimately the firm's value.

Economic risk can affect the present value of future cash flows.

- binary option indonesia apakah penipuan.

- forex trendy user reviews.

- forex tv news live.

- studio del forex!

- forex advisor generator.

- forex que es y como invertir!

An example of an economic risk would be a shift in exchange rates that influences the demand for a good sold in a foreign country. Another example of an economic risk is the possibility that macroeconomic conditions will influence an investment in a foreign country. When financing an investment or a project, a company's operating costs, debt obligations, and the ability to predict economically unsustainable circumstances should be thoroughly calculated in order to produce adequate revenues in covering those economic risks.

As a result, all possible risks that outweigh an investment's profits and outcomes need to be closely scrutinized and strategically planned before initiating the investment. Other examples of potential economic risk are steep market downturns, unexpected cost overruns, and low demand for goods.

Foreign exchange risk - Wikipedia

International investments are associated with significantly higher economic risk levels as compared to domestic investments. In international firms, economic risk heavily affects not only investors but also bondholders and shareholders, especially when dealing with the sale and purchase of foreign government bonds. However, economic risk can also create opportunities and profits for investors globally. When investing in foreign bonds, investors can profit from the fluctuation of the foreign-exchange markets and interest rates in different countries.

Changing laws and regulations regarding sizes, types, timing, credit quality, and disclosures of bonds will immediately and directly affect investments in foreign countries. For example, if a central bank in a foreign country raises interest rates or the legislature increases taxes, the return on investment will be significantly impacted.

As a result, economic risk can be reduced by utilizing various analytical and predictive tools that consider the diversification of time, exchange rates, and economic development in multiple countries, which offer different currencies, instruments, and industries. When making a comprehensive economic forecast, several risk factors should be noted.

One of the most effective strategies is to develop a set of positive and negative risks that associate with the standard economic metrics of an investment. It is equally critical to identify the stability of the economic system. Before initiating an investment, a firm should consider the stability of the investing sector that influences the exchange-rate changes.

For instance, a service sector is less likely to have inventory swings and exchange-rate changes as compared to a large consumer sector. A firm has contingent risk when bidding for foreign projects, negotiating other contracts, or handling direct foreign investments. Such a risk arises from the potential of a firm to suddenly face a transnational or economic foreign-exchange risk contingent on the outcome of some contract or negotiation. For example, a firm could be waiting for a project bid to be accepted by a foreign business or government that, if accepted, would result in an immediate receivable.

While waiting, the firm faces a contingent risk from the uncertainty as to whether or not that receivable will accrue.